Part 2 | The Budget Breakdown: This is a 3-part story that looks into the 2025 budget for the City of Toledo, passed by Toledo City Council on Jan. 28

> Read the entire story here.

> Continued from Part 1 <

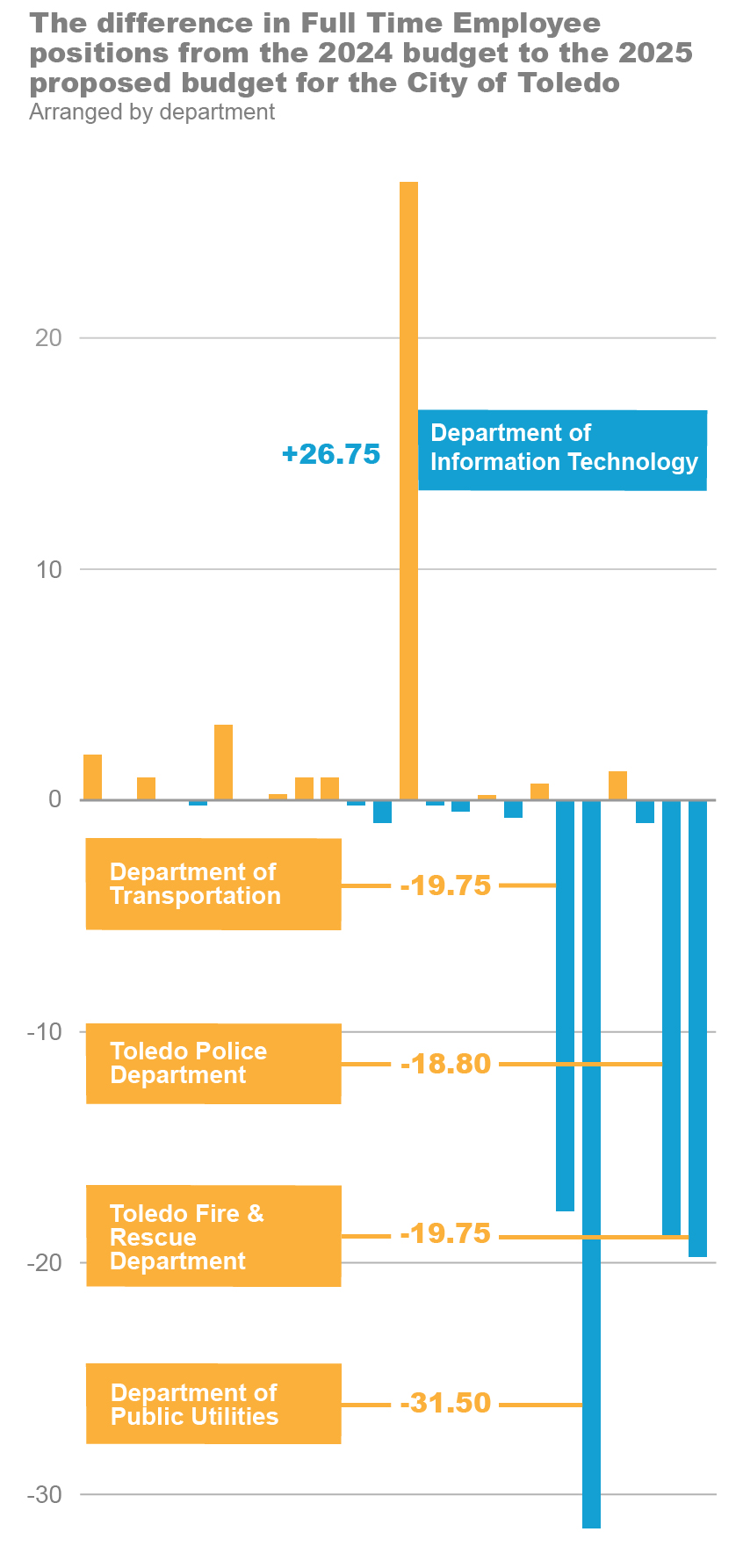

TOLEDO – Not as openly touted in the budget were the additional positions added to the Department of Information Technology (IT), a full 26.75 FTEs (full-time equivalent).

This includes more than double the previous year’s Engage Toledo positions, up to 34 FTEs from 12.5 in 2024.

“The budgeted FTEs for IT have increased compared to the 2024 budget due to the consolidation of the Engage Toledo Call Center with the Department of Public Utilities call center,” the budget summary explained, helping shine light on the 31.5 FTEs taken from the Department of Public Utilities.

The Department of Information Technology’s added 26.75 FTEs at the expense of the Department of Public Utilities’ loss of 31.5 FTEs accounts for the largest FTE changes in the budget, and also puts in perspective the boast of eliminating 55 government positions.

Total FTEs for the 2025 year are 2,990.43, which constitutes -54.30 from the previous year, but bear in mind that 26.75 FTEs of the 34 Public Utility Call Center were added back to the budget in a different department.

“We eliminated 55 vacant positions in our budget,” Kapszukiewicz told the Free Press. “In other words, if these positions were being funded and weren’t filled, that kind of told us that the service wasn’t, maybe, essential.

“So, we eliminated the funding for those positions, which saved money, freed up money. That is a sign of, I think, good budgeting,” he added.

The elimination of those positions put Toledo in a position to receive $60 million in savings by the end of 2025.

“The city’s long-term goal is to maintain a fund balance reserve of approximately two months’ of operating expense in the General Fund,” the budget states.

Moves like these are what Kapszukiewicz believes led to the city’s improved bond rating (something akin to a credit score for cities), which was improved by Moody’s to an A2 rating, and Standard and Poor increased their rating to an A from an A-.

“Standard and Poor (S&P) and Moody’s [Analytics CRE] don’t care about politics; they just care about the nuts and bolts, and for them to bless our budget the way they did, I think should give citizens confidence that we’re moving in the right direction,” noted Kapszukiewicz.

Funding, generally

Other funds on the books:

- Capital Fund budget of $81.4 million

- A roads budget of $27 million

- A capital improvement to general fund transfer of $24 million

- An across-the-board 4 percent wage increase for all Toledo city employees, not just police and firefighters.

Not every comparison is one-to-one, but many of the challenges Toledo faces are similar to Detroit’s and other cities, whose economies relied heavily on manufacturing.

These challenges include, but aren’t limited to, declining populations, the decline of the manufacturing industry, higher crime rates and the persistence of blight, all problems that require extra funds to tackle.

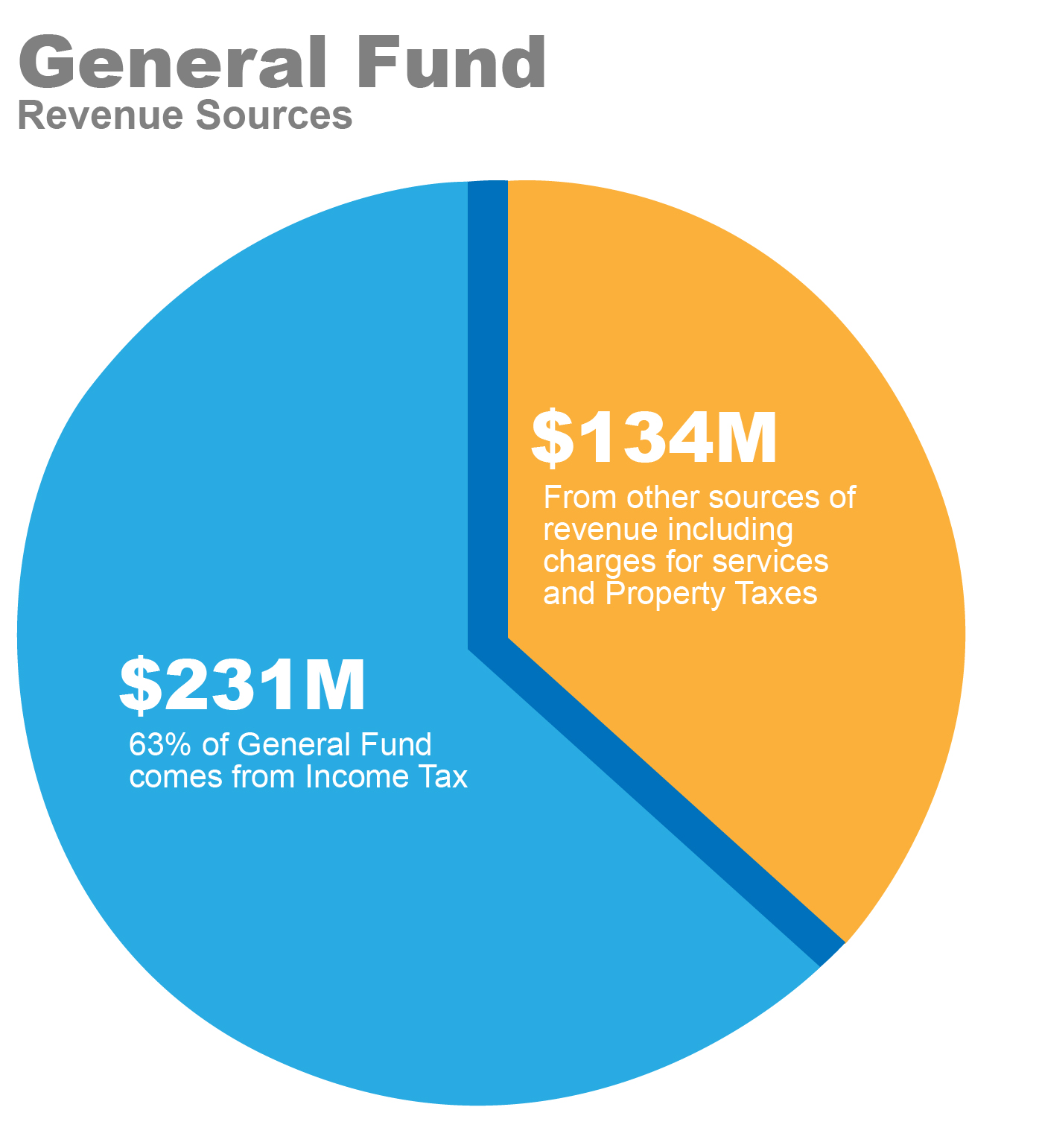

Of that total of $365 million in the General Fund, $231,303,710 comes directly from Toledo citizens’ income taxes, and this is the main revenue used by the City of Toledo to fund the General Fund.

Currently, Toledo charges a 2.5 percent income tax, higher than most of the surrounding suburbs who charge between 1.5 percent to 2.25 percent income tax rates.

“Our income tax collections are as high as they’ve ever been. If we were facing economic peril, that wouldn’t be the case,” said Kapszukiewicz about the total amount of income tax taken in, not the rate.

Comparatively, the city of Detroit’s income tax rate is 2.4 percent, and their property tax rate is 2.24 percent to Toledo’s 2.43 percent property tax rate. Detroit received $892,898,710 for their population of 633K in their general fund from “taxes, assessments and interest,” which is roughly 60 percent greater revenue per-person in spite of their lower tax percentages.

Detroit’s allocation would be about $592 million instead of their $892 million if they collected revenue like Toledo does.

Considering Detroit’s 33 percent poverty rate to Toledo’s 24 percent, and Toledo’s $45,000 yearly median income to the Census Bureau’s reported $39,000 median income for Detroiters, it’s clear Detroit receives a different source of taxable revenue to supplement their expenses.

Work with what you’ve got

In defense of the budget, the mayor has said that “Toledo doesn’t have a spending problem; it has a revenue problem.”

Detroit fills out their General Fund with taxes it gets from a “recurring wagering tax” on retail and internet sports betting. Detroit expects to gross $282.6 million in taxes in 2025 from sports betting alone. In 2020, the wagering tax only grossed $130 million, but since then, including last year, the tax on sports betting has pulled in upwards of $250 million, more than Toledo’s entire income tax revenue.

Morally questionable to some, betting may not be ideal, but the results are clear: Taxes on betting pay off. And a considerable amount of the betting doesn’t require a physical location, as the wagering tax collected $158 million from Detroit’s three casinos last year and a separate $106 million from online sports betting.

Toledo’s position in Ohio makes it more difficult for the city to benefit from a wagering tax, as the state itself taxes betting, splitting the majority of the tax revenue between Ohio’s 88 counties. As a host city of betting, due to the Hollywood Casino, Toledo would only be able to receive 5 percent of the total taxes taken in by a wagering tax.

If Ohio’s tax system was applied to Detroit, it would only receive $12.5 million of $250 million it would regularly gross.

Regardless, Detroit did much more than tax betting to bring in money, and also pursued grants to invest in its city, as Toledo has. Decades of work in Detroit has paid off.

“For the first time since 1957, the city of Detroit is growing again — not Wayne County — the city of Detroit,” Kapszukiewicz emphasized.

On their website, the City of Detroit lists these accomplishments as the behind-the-scenes work leading to the recent growth in the Motor City, all of which require heavy funding and investment.

- $1 billion invested in more than 4,600 units of affordable housing over the past five years

- Job growth with more than 25,000 more Detroiters employed since 2014

- A return to investment-grade bond status for the first time since 2009

- $3 billion in added wealth for Detroit’s Black homeowners since 2014, according to a University of Michigan study

- Reductions in crime, beating national trends, including the fewest homicides in 57 years

- Successfully hosting the largest ever NFL Draft at 775,000 people in over three days

The fight against blight

Along with these steps, Detroit has actively fought blight aggressively in their city for decades.

“Blight removal is critical to the resurgence of cities across Michigan,” said U.S. Sen. Gary Peters, (D-Mich.), in a Detroit Free Press article.

Likewise, U.S. Sen. Debbie Stabenow, (D-Mich.), said in 2016, ahead of a federal allocation to remove blight, that “we have the most sophisticated blight removal program in the country.”

Quality housing and a healthy job market are the two key factors Rachel Blakeman, director of Purdue University Fort Wayne’s Community Research Institute, said were keys to Fort Wayne’s recent growth.

Growth in Fort Wayne has been noticed by the U.S. Census Bureau, who labeled Fort Wayne as the fastest growing large city in the Midwest, and in 2022, Fort Wayne surpassed Toledo’s population for the first time.

“Since Fort Wayne hasn’t annexed in any statistically meaningful way in many years, this growth is organic – either by more people moving into the city or more babies being born – rather than a redrawing of the city limits,” Blakeman said in a quote touted on the city of Fort Wayne’s website.

These population increases are the product of a myriad of factors, but one common factor between both Detroit and Fort Wayne is an annual governmental allocation by both cities to deal with blight.

An “Unsafe Building Fund” was established in the early 2020s, and last year Fort Wayne gave $2,970,646 to oversee. According to the Fort Wayne budget: “The repair or demolition of those buildings which are dilapidated, substandard, or unfit for human habitation and which constitute a hazard to the health, safety, and welfare of the citizens of the City…”

In the upcoming year, the Indiana city set aside $2,487,205 for the fund, and Detroit approved a plan to do likewise with $34.2 million in their Blight Fund.

Local housing efforts

Toledo’s main organization dealing with property remediation is the Lucas County Land Bank, whose CEO spoke on some of the housing challenges in Toledo.

“We have a very old neighborhood housing stock,” said David Mann, CEO and president of the Land Bank. “The average age of a house built in Toledo is built before 1940.

“Anything that old is going to need ongoing maintenance, and because of a lack of wealth in our community, because of challenges over the last generation, much of that housing stock has not been maintained in the way that it needs to,” he added.

In the Economic Development part of the 2025 budget – a $28.5 million grant for Reconnecting Communities and Neighborhoods from the U.S. Department of Transportation to make street improvements to Front and Main Streets in East Toledo, adjacent to the ongoing Metroparks Toledo Riverwalk projects – is cited as a means for providing safer, better connected and “more visually appealing” streetscape for east Toledo; however, there isn’t a concise plan to deal with this aging housing stock in Toledo.

“By using data analytics to identify and prioritize blighted properties, engaging community members in the process, and being more cost-effective than traditional approaches, cities such as Detroit, Baltimore, and New Orleans have been able to reduce blight rates, and therefore reduce the associated negative impacts, while revitalizing the local community,” wrote Natalia Gulick De Torres, a graduate student at the Harvard Graduate School of Design and research assistant for Data-Smart City Solutions, in an article titled Cities Are Not Overbuilt, But Underdemolished: Data-Driven Strategies for Blight Removal.

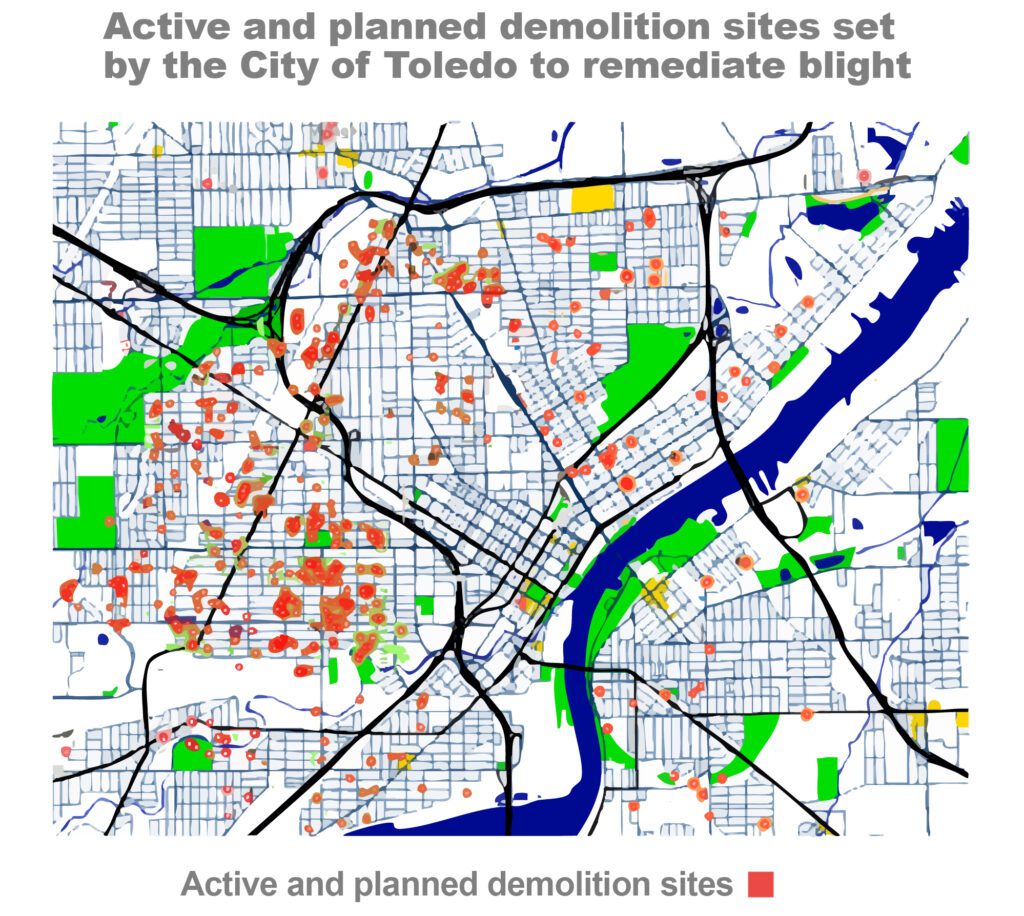

Negative impacts of blight are many, including reticence for business investors, heightened crime rates, (in some cases) heightened health risks, lower property values and lower revenues overall for the community.

The Lucas County Land Bank approaches blight by demolishing properties that are too far gone, renovating properties themselves or handing the properties over to people to renovate them on a timeline.

A percentage of delinquent property taxes serves as the land bank’s most reliable funding source.

“It’s a mechanism that only exists in Ohio,” Mann said, and explained that “Ohio county land banks are able to access a portion of the penalty and interest, so, last year, that was about $1.7 million. After that, we either generate the income ourselves through the work that we do, or we compete for grants.

“We are a piece of the puzzle at the Land Bank … but I don’t want to pretend to you that the $1.7 million that we have access to a year is anything close to what’s needed to actually meet the community’s overall needs,” Mann said.

The division of Urban Beautification houses the city of Toledo’s demolition program, which currently has 491 properties planned or actively in process of demolition. Most of these demolitions fall into the City of Toledo’s Districts 1, 3 and 4, most heavily concentrated in the Junction and Englewood neighborhoods, but are fairly present in many neighborhoods surrounding downtown, uptown and the Warehouse District.

“All of this is very, very, very expensive,” Mann said, referring to the process of building, renovating or demolishing housing. “Because housing is just very expensive by its nature, but making these kinds of investments now means that even though they’re expensive, this is as cheap as it’s ever going to get.

“If we continue to defer some of these challenges for another decade, well, they’ll be way more expensive 10 years from now,” he reasoned.

With better housing, it’s likely Toledo’s crime rate will drop, and with better housing and safer neighborhoods, it’s likely companies will invest.

“Our neighborhoods will be more stable if we can continue to invest in maintaining and preserving what is already here. It was very expensive to build this community out over the last 100 years, and the cheapest way for us to continue to support it is to make continued investments in that,” Mann said.

Part 3 | The Budget Breakdown continues Jan. 31.