Planning ahead for financially stable and fulfilling retirement

How should Gen X plan for retirement.

It is great to be back writing for the Toledo Free Press. As a TFP columnist from 2008 to 2015, I spent a lot of my time talking to local Baby Boomers about how to get ready to retire. Flash forward to today, and, before you know it, the next generation will start transitioning into retirement. Generation X, ranging from 44 to 59 years old, should consider these great tips.

For workers less than 10 years from retirement, now is the time to get serious about stress-testing your retirement plan. Our team uses financial planning software from Right Capital, which allows us to input data and goals and then run a Monte Carlo analysis to determine the probability of a family reaching their retirement goals.

In stress-testing the plan, look at scenarios like what happens if the stock market crashes, tax rates increase, or inflation stays high. Knowing these answers allows you to make investment decisions now to reduce or eliminate those risks in the future.

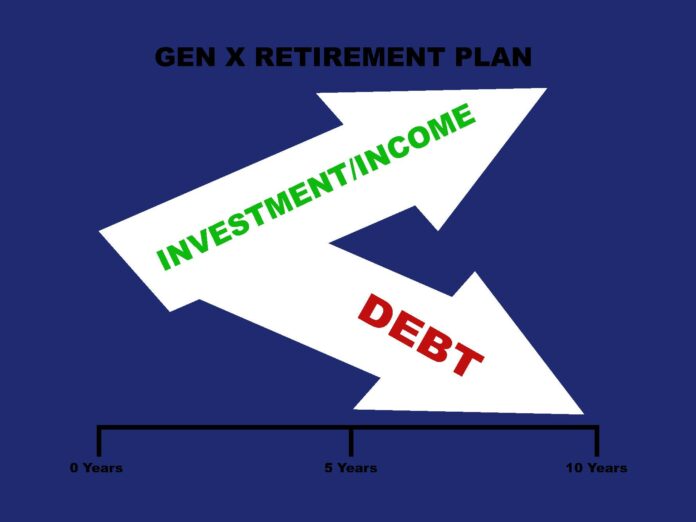

Retirement is going to be all about income. A way to boost income in retirement is to be debt-free. Aggressively paying off debts before retirement can be a great move. Next, look at reliable income sources, such as pensions and Social Security. I believe that a retiree will want to have enough reliable income to cover their minimum monthly income needs.

If you add up your reliable income versus your needs and find a gap, start working toward adding to an account that will provide predictable income at retirement such as a fixed investment. Avoid taking Social Security early and facing a lifetime reduction of benefits. Work on building a bucket of money to help bridge this gap.

Inflation is the real deal, and for retirees living on a fixed income, health care costs, food and energy bills will add up. Build inflation into your plan by setting up a second bucket of money designed to give a pay raise five and 10 years after retiring. This account could also be a fixed type of investment. By using a fixed investment, the account owner will know exactly what the investment will be worth in the future and how much income it will provide.

Equity-based investments are typically in 401(k) or Individual Retirement Accounts. This is the growth part of the plan. Build these as big as possible, as this is typically the account that can be used for the fun stuff in retirement. If there are more than five years until retirement, consider optimizing the portfolio and using a strategic mix of asset allocation. If retirement is less than five years away, it may be time to be more tactical with investment moves and reduce equities when short-term risk is elevated.

The last remaining piece of the investment plan is to ensure a good emergency account is funded in case of an unexpected job loss, health care issues or helping a loved one out. At some point, everyone experiences an emergency, so be prepared for it. I recommend that a family keeps six months of living expenses set aside in an emergency account.

Planning for retirement can seem overwhelming, but with careful preparation and strategic decisions, you can create a secure and enjoyable future. By focusing on stress-testing your retirement plan, eliminating debt, ensuring reliable income, accounting for inflation, and maintaining a solid emergency fund, you can navigate the complexities of retirement with confidence. Remember, it’s never too early or too late to start planning.

Take proactive steps today to ensure a financially stable and fulfilling retirement tomorrow.