Having endured the most recent presidential election in our great country, I can’t help but think of a scene from the movie, The American President, when President Andrew Shepard (portrayed by Michael Douglas) speaks to the White House press corps about his political presidential opponent – Sen. Bob Rumson (portrayed by Richard Dreyfuss).

At one point in the press conference, Shepard said, “We have serious problems to solve, and we need serious people to solve them. And whatever your particular problem is, I promise you Bob Rumson is not the least bit interested in solving it. He is interested in two things, and two things only: Making you afraid of it and telling you who’s to blame for it.

“That, ladies and gentlemen, is how you win elections. You gather a group of middle age, middle class, middle income voters who remember with longing an easier time, and you talk to them about family and American values and character, and you waive an old photo [showing her burning a flag in protest] of the president’s girlfriend, Sydney Ellen Wade, portrayed by Annette Benning] and you scream about patriotism. You tell them that she’s to blame for their lot in life,” Shepard said.

This is a scene in which Wade could be a substitute for the pillars of the MAGA campaign – immigrants, transgender individuals and the price of eggs.

And voila …. life imitating art. You can find the speech at americanrhetoric.com.

Donald Trump convinced 49 percent of American citizens who showed up to the polls or mailed in a ballot (less than two thirds of the eligible voters in the country – hence the saying bad politicians get elected by good people who don’t vote) that their problems were immigration, transgender athletes and the price of eggs.

Get people to believe that all their troubles are due to immigrants (you remember, other countries “are cleaning out their prisons and insane asylums,” or “you can’t go to buy a loaf of bread without getting mugged or raped,” or, “they are eating your dogs and cats”).

Forget about the fact that there were fewer homicides in 2021 and 2022 under Biden, compared to 2020 when Trump occupied the White House.

Forget about the fact that according to Bloomberg, “On balance, immigrants boost our economy and help to mend our nations broken public finance,” and “Immigrants will add $1.2 trillion to federal revenue over the next decade, about as much as raising everyone’s personal income taxes by one percent. Federal spending [for immigrants] will go up by $300 billion, but the net effect will be a cut in federal borrowing by $900 billion.”

In her debate appearance on national TV, Kamala Harris at times provided some word salad answers, but I would have taken that over a liar who tried to convince the American people in his debate appearance that Haitian immigrants were eating people’s pets in Springfield, Ohio.

I would like to be on the party line (yes, I am old) when the factory owner calls Trump to tell him if he deports all the Haitian immigrants, who are in the United States legally, that there will not be enough workers left in Springfield to get the production out.

Folks, countries that aren’t at least maintaining population are in decline economically. According to the U.S. Census Bureau, deaths will outpace births sometime between 2038 and 2042, about the same time Social Security will not be able to fully meet its obligations to our seniors. In 2023, there were 129,300 babies born in Ohio, the lowest number since the 1950s. Ohio has a projected drop of 675,000 people in population by 2050.

From 2010 to 2020, Ohio saw a net gain in population of 60,000, thanks to immigrants. This was the first decade of gain in immigration in Ohio since the 1950s. These are the folks who will be paying into our Social Security system and the taxes to fund necessary government programs. Unless you are a Native American, we are all immigrants to this country. We are a bunch of mutts.

My grandmother came here when she was three years old from Poland. Yes, there was resistance to immigrants during that period in our history. Ugly and hateful names were given to these tired, poor and huddled masses, but we survived and grew to be the greatest nation on earth.

America does not need to be made great again, for we already are. Despite our faults, we are still the shining light on the hill for the rest of the world, but that is being called into question by our allied democracies across the globe.

But haters continue to hate. They must win elections at all costs. Who else is there to fear and blame?

Trump/Musk and their ilk spent $215 million, according to AD Impact and cited in the Washington Post, in an anti-transgender campaign. Forget about the fact that out of 530,000 NCAA athletes, less than 10 are transgender, according to NCAA president Charlie Baker in his testimony to U.S. senators in February 2025.

But, as FOX News filmed Trump saying, “They take your kid – there are some places, your boy leaves for school and comes back a girl.” Kids dealing with gender identity have enough to worry about already. They do not need the government making their lives tougher. This expensive fear campaign is a tempest in a teapot.

As for the price of eggs…50+ days and counting…no relief in sight.

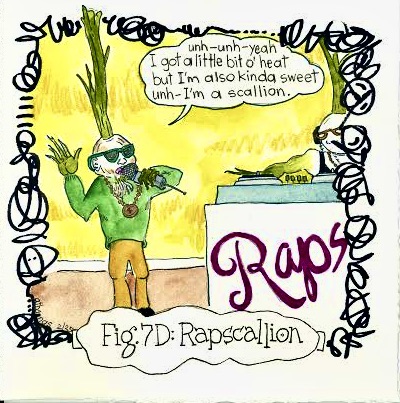

To quote Shepard in the film, “That, ladies and gentlemen, is how you win elections.” Fear and blame.

If you supported Trump/Musk in this past election because you truly believed the things they made you fear and blame, look at the facts; don’t buy the hype. Remember who we are as a nation and how we got here. Our immigration system is in need of repair. A bipartisan bill offered in the Senate would have gone a long way to fixing the problems with the system. But that would have taken away a major contributor to fear and blame. Mass deportation will not prove to be the answer. It has been tried before, much to America’s shame.

If you knew it wasn’t about immigrants, transgenders or eggs, but allowed yourself to vote for Trump/Musk because you thought it was in your economic self-interest, search your soul and ask if the carnage we are witnessing is worth some hoped for windfall. (No Earl…the check is not coming).

To quote Shepard one final time, “America isn’t easy. America is advanced citizenship. You’ve got to want it bad, cause it’s going to put up a fight.”

Make the effort to learn the facts. The facts won’t fit on a bumper sticker. It won’t be a catchy phrase tested and polled by an expensive ad agency. It will require some “advanced citizenship,” but as Americans, we owe it to each other.

Take the time to learn the facts: