Driver’s ed privatization fails teens

Some young Ohioans are unable to drive legally, limiting their job options and ability to participate in extracurricular activities. But some are pushing to return driver’s ed to schools

This story was originally published by Signal Statewide. Sign up for their free newsletters at SignalOhio.org/StateSignals. Statewide is a media partner of the Toledo Free Press.

By Andrew Tobias | Signal Statehouse

Homer Weekly realized the state had a big problem around 2017, when the private driver’s ed school he ran with his wife in Morgan County started seeing students from places farther and farther outside his small southeastern Ohio community.

“We were getting students from Westerville,” Weekly said, referring to the Columbus suburb 90 miles away. “Parents told us their kids were on waiting lists of over 90 to start driving lessons. That’s when we knew it had become a crisis.”

This type of training used to commonly be provided by high schools. But Weekly, a retired educator, opened his school in 1993, shortly after state lawmakers privatized the industry.

Today, Weekly works for a new, fast-growing school-based driver’s ed program based in Zanesville. It’s on the cutting edge of an effort by Gov. Mike DeWine and others to try to revive public driver’s ed.

In interviews and public comments, state officials and advocates describe a failed privatization effort, particularly for rural and poor urban areas. The result has been a system with limited enrollment slots, high prices and slim profit margins for operators.

In turn, many 16- and 17-year-old Ohioans are unable to drive legally.

This limits their job opportunities and their ability to participate in extracurricular activities. It also places them at a higher risk for crashes if they get their licenses after they turn 18 without driver’s ed, according to a state-funded 2022 study conducted by the Children’s Hospital of Philadelphia and the University of Pennsylvania. Of course, kids do get behind the wheel regardless.

Ohio officials said of the 113 fatal crashes in 2023 that involved teenage drivers, the teen driver lacked a license or permit in 23 percent of those crashes. Ohio officials don’t track exactly how many teens are unable to access driver’s ed. But advocates and people in the industry are aware of the problem.

A different state-funded study completed in 2023 by the same researchers found that teenagers who live in poorer neighborhoods around Columbus were four times less likely to complete driver’s education than others.

“It’s a huge, huge problem, even for families that have the ability to pay for access to it,” said Kristy Amy, chief of programs for Future Plans, a Geauga County-based nonprofit that works to fight poverty in Appalachian Ohio.

How driver’s education works – and doesn’t work – in Ohio

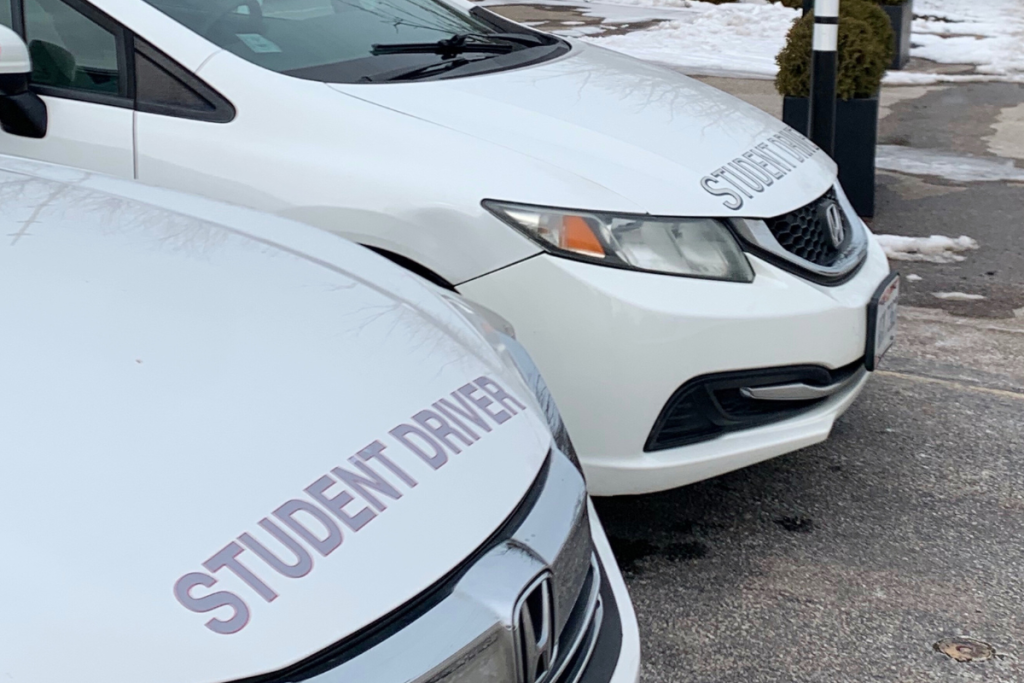

In Ohio, there are two paths to becoming a licensed driver. One applies to 16- and 17-year-olds, who must get 24 hours of classroom instruction — this increasingly is being offered online — and eight hours of in-car training before they can get their license, among other requirements.

The other applies to everyone 18 and up, who must simply pass a driving test and a written exam and undergo a test of their eyesight.

For new drivers under 18, education options can be limited, either because of affordability, or, in the case of rural areas, physical proximity.

Quantifying the problem is difficult. Ten counties in Ohio — Adams, Brown, Harrison, Monroe, Morgan, Noble, Paulding, Pike, Vinton and Wyandot — have no schools offering driver training, according to the state government’s list of licensed providers.

But state officials say their records may not capture the true picture, since the records may just show the providers’ corporate headquarters and not any ancillary facilities, and since schools may offer driver training in a wide area.

Still, advocates and industry officials say there’s clearly a widespread problem in two types of communities – poorer, urban areas where many residents can’t afford driver’s education and in rural areas, where people can’t afford driver’s education and may not have a nearby option.

“Driver’s ed’s expensive,” said Mike Belcoure, manager of driver’s education for AAA Alliance Inc., one of Ohio’s major AAA clubs. “There’s no better way to put it. It is expensive and it prices, unfortunately, some people out of the market.”

AAA Alliance’s in-car driver’s training instruction, based in and around Cincinnati, Columbus and Dayton, costs $650 per student, Belcoure said. Depending on the market, prices can range as low as $400 and as high as $950, he said.

Families face a waitlist for driver’s education classes

Another issue is waitlists. State law requires students to complete driver’s education within six months. So a student who completes classroom training must also be able to quickly find a driver’s training school with availability.

But the waitlists lengthen for providers further away from major cities, he said.

“You go out to the eastern part of the state, it becomes tough. There are, we call them in the industry, driver’s ed deserts where the supply’s just so low, it is hard for students to find,” Belcoure said.

AAA is a nonprofit, member-owned cooperative, and driver’s education is part of its mission. But for mom-and-pop, for-profit operators trying to get started, starting and running a driver’s training school is a difficult proposition.

Major costs for driving schools include buying and insuring vehicles, and hiring instructors who are willing to get in the car with inexperienced teenage drivers. Some schools were forced to close during the coronavirus pandemic and haven’t reopened.

This explains why private schools are more likely to be available in big cities, where they can count on higher volumes of students.

“Driver training is a difficult business model,” said Kimberly Schwind, assistant director of the Ohio Traffic Safety Office, part of the Department of Public Safety. “Instructors don’t get paid a lot. So it’s difficult to find instructors. You need instructors to find kids. If you pay instructors more, you have to raise prices more. And it’s already too high for most families. It’s a difficult situation.”

One major rural driver’s education business, Capabilities Inc., is able to meet its bottom line in part by doing work for the government. The company, which is based in Saint Marys with satellite locations around the western, central and southern part of the state, does a significant amount of business by offering training to developmentally disabled adults, which makes it eligible for local and state funding.

Owners Bill and Karen Blumhorst say their company also offers traditional under-18 driver’s training for $450 in Saint Marys because they’re committed to their community.

But, in the roughly 25 years their company has been in business, “There definitely are times we’ve discussed, is it financially prudent to keep on providing the service?” Karen Blumhorst said.

DeWine calls for expanded driver’s ed requirements

Despite the existing system’s limitations, DeWine late last year announced he’d like to change state law to require all new drivers, and not just 16- and 17-year olds, to go through driver’s ed before getting their license.

The proposal got some wider news coverage due to issues faced in Springfield, where a mass influx of Haitian migrants has introduced a large number of drivers who are unfamiliar with U.S. driving laws.

DeWine has taken other steps in the past couple of years to address driver’s education availability, such as creating a scholarship program targeted at rural and urban areas. State officials say their Drive to Succeed scholarship program spent $3 million paying to put 5,500 students – or about $550 per student – through driver’s education.

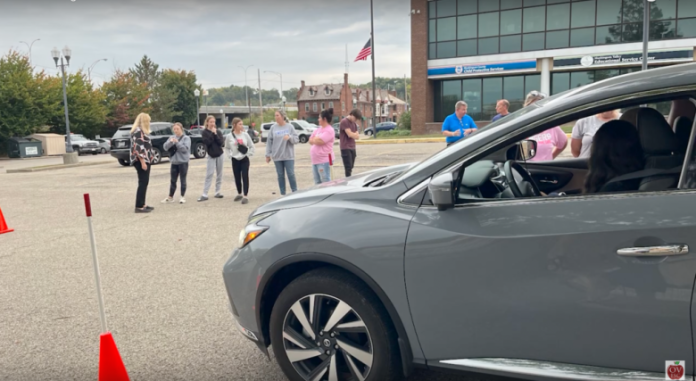

At a Springfield City Commission meeting in October, DeWine’s public safety director, Andy Wilson, said the governor and Ohio First Lady Fran DeWine met with insurance industry executives in the summer of 2024 to discuss the plan to boost driver’s education requirements.

After commission officials raised concerns about the price of driver’s ed, Wilson acknowledged the lack of existing access. He said it traces back to state officials’ decision to move driver’s ed out of public schools in the early 1990s.

“The state privatized it. And when they did they radically altered the model, they radically altered accessibility, and they radically altered capacity. So yes, there is a problem.”

In recent comments to reporters, DeWine said he’ll be talking to lawmakers about ways to expand driver’s ed access soon, possibly via the state budget bill he’s planning to release next week.

“This is something I think that is very needed. There’s a lot of, I think, support for that out there. So we’ll be talking more to the legislature about that in the months to come,” DeWine said.

A possible blueprint to expand driver’s ed opportunities

The new driver’s education program that Homer Weekly runs in Zanesville could offer a blueprint for how the state will approach this issue.

Weekly works for a public school-based driver’s education program called the Muskingum Ohio Valley Educational Service Center Driving School that’s supported by two different education service centers, government agencies that provide support services to local districts.

Local education service officials launched the program in October 2022 using federal coronavirus relief money. The program has expanded thanks to a $1 million state grant in January 2024, awarded by the DeWine administration as part of the state effort to expand driver’s training options.

Weekly and his colleagues run what amounts to a franchise model for driver’s ed. Four core employees administer the program from offices in Zanesville and Cambridge, handling money, developing curriculum and hiring, training and evaluating drivers, among other responsibilities.

Students pay $350 — the very low end of the market price range. And participating school districts provide state-approved driver’s education, including in-car instruction.

Its handful of employees include Weekly, who is a former assistant principal and school athletic director, and Richard Hall, a former superintendent at the Mid-East Career and Technology Centers in Zanesville.

Program leaders say in-school driver’s education solves some of the major problems private providers face.

First, direct government subsidies allow them to charge lower prices. Schools also can roll a major driver’s ed expense — vehicle insurance — into their existing fleet insurance for their school buses.

Schools also help provide a pool of motivated driving instructors, in the form of teachers, bus drivers, cooks and other school employees. Two-thirds of the program’s instructors are school employees, officials said.

They also provide a centralized point to pick up kids and are able to more easily work around the students’ academic schedules.

The biggest burden the driving program poses, program officials say, is the cost of buying cars.

“We have schools in this area that do not offer driver’s ed through us. They stay out of the driver’s ed business, and I think they don’t understand how easy it is for them,” Hall said.

The state grant has allowed the program to grow rapidly. It began with 13 school districts, but today covers 30 districts in 18 counties ranging from Oxford near Cincinnati to the Toledo area.

“I think, you know, it’s just going to catch fire, just like anything else, that it’ll be in almost every school in a couple years,” said Eastin Lewllyn, an official with the Muskingum Valley Educational Service Center that helps runs the program.

The growth has happened with no real advertising, program officials said, and little news coverage.

Program officials say that some private providers aren’t thrilled with their expansion, viewing it as the government competing with and threatening their livelihood.

Private driver’s ed providers recently organized a trade group called the Ohio Driving School Association. The group didn’t return messages.

But officials at the Muskingum Ohio Valley Educational Service Center Driving School believe in their model, saying it prioritizes education, not profit.

“We’re fortunate by our model and being educationally based. If a kid needs something, we don’t need to charge you for it. We have enough resources to do that,” Hall said. “A small school doesn’t have that.”

Signal Statewide is a nonprofit news organization covering government, education, health, economy and public safety.

Toledo’s 2025 budget breakdown

TOLEDO – Vision casting for the new year is not lost on local governments, as plans and funding need to be approved in their yearly budgets.

In November, Mayor Wade Kapszukiewicz presented his 2025 budget to Toledo City Council, who had until the end of March to make changes and approve the 212-page document. City council passed the budget on Jan. 28.

The 2025 city budget completes the transition off of American Rescue Plan Act (ARPA) funds, while maintaining current operations, eliminates 55 Full Time Employee (FTE) positions in the budget, and allowed for saving $60 million by the end of 2025, leading to an increased bond rating for the City of Toledo.

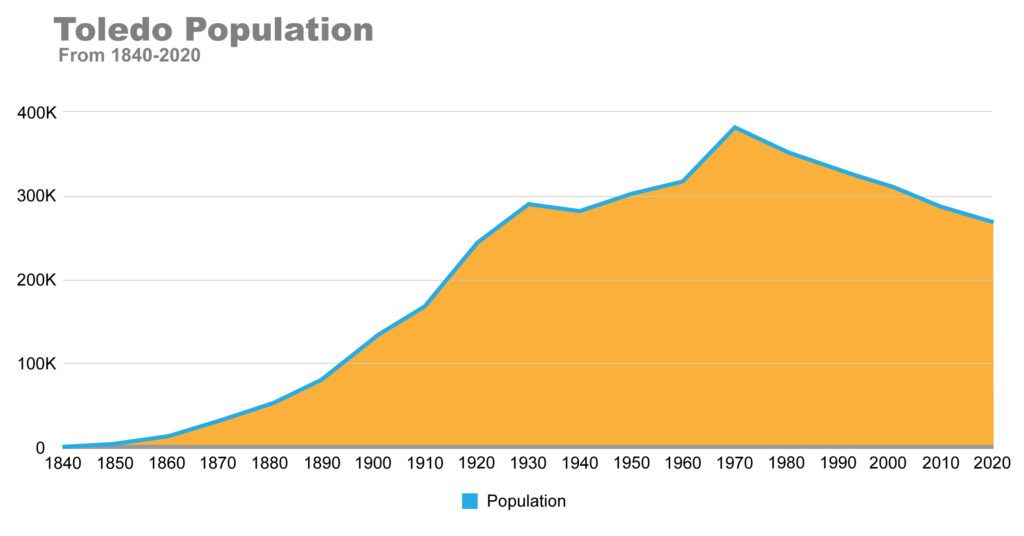

Economic development plans in the budget focus on a new Glass Center of Excellence, based in Perrysburg that will bring in more jobs, and renovating east Toledo streets surrounding the Glass City Riverwalk. Toledo’s main challenges remain finding enough money to invest in remediating blight or poorly maintained areas, lowering crime rates, attracting future investments within the city and reversing Toledo’s chronic population decline.

According to Kapszukiewicz, this new budget invests further in public safety, including a 4 percent raise for government employees, roads, community initiatives and a sizable “rainy-day” fund.

Breaking down the total budget

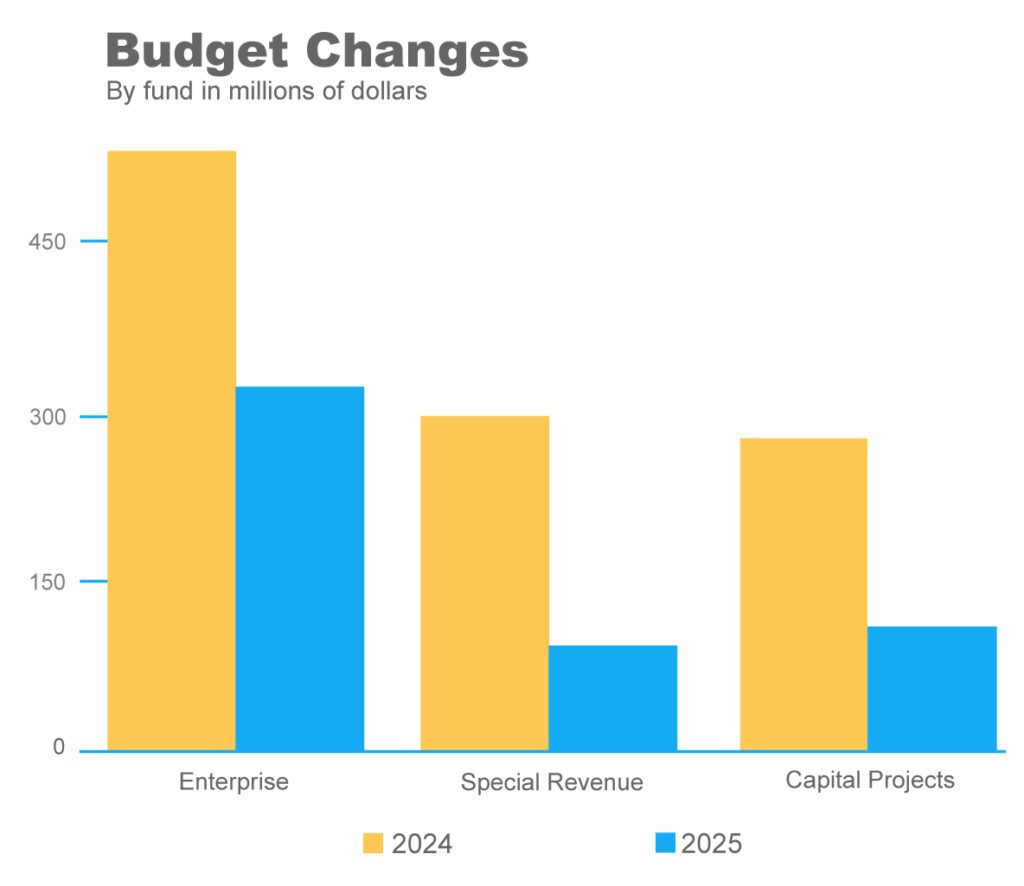

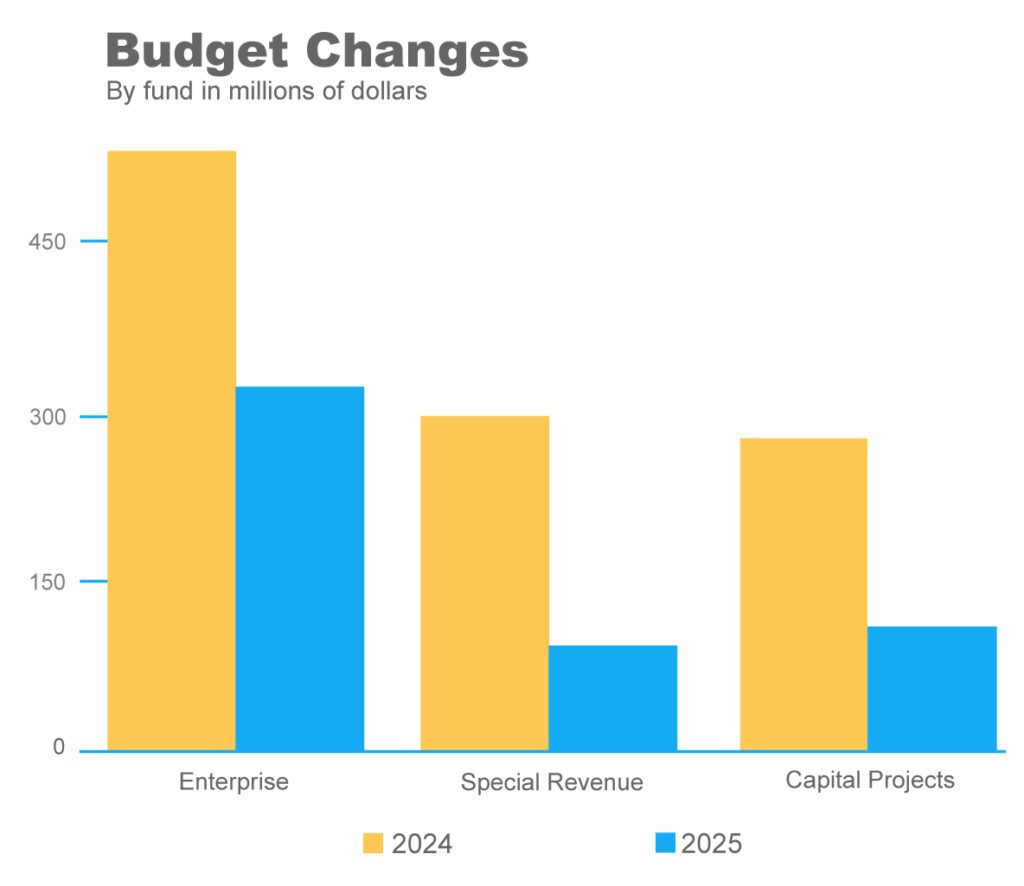

About $1 billion was proposed for the entire city budget, which is down by about half a billion dollars from last year. The main cuts to the overall budget were made in the following sections:

- Enterprise ($526M to $317M)

- Special Revenue ($294M to $94M)

- Capital Projects ($276M to $111M)

The Toledo Free Press will be diving into these numbers in the future, but part of the reason for this drop-off is supplemental grant funding.

Melanie Campbell, the interim finance director, clarified that the 2024 budget included grants and capital projects that are in process, which can span multiple years.

One such grant are the funds associated with the American Rescue Plan Act (ARPA).

“In 2020 and 2021, the federal government made a historic level of investment in local governments and local communities, a level we haven’t seen since the Great Depression,” said Simon Nyi, the grants commissioner for the City of Toledo. “And Toledo has done a good job of getting our fair share of that money.”

In total, Toledo received $180.9 million in ARPA funds in 2021, on par with much larger cities, like Columbus, Ohio, which received $187 million in ARPA funds.

“The numbers make it clear that on a per-capita basis, we have been among the most successful cities in Ohio at securing these grant dollars, and we’ve been succeeding at a level comparable to much larger cities nationwide; there is no question that we’re ‘punching above our weight,’” Nyi said when referring to the total amount of grants Toledo received (not just ARPA).

Projects funded with ARPA include afterschool programs, parks projects and — most prominently — $19 million of the $28.7 million for the up-and-coming Wayman D. Palmer YMCA in the Warren-Sherman neighborhood, a neighborhood Kapszukiewicz said has been overlooked for years.

ARPA funds will be spent into 2026, but had to be obligated, not just budgeted, before the end of 2024. All ARPA funds must be spent by the end of 2026.

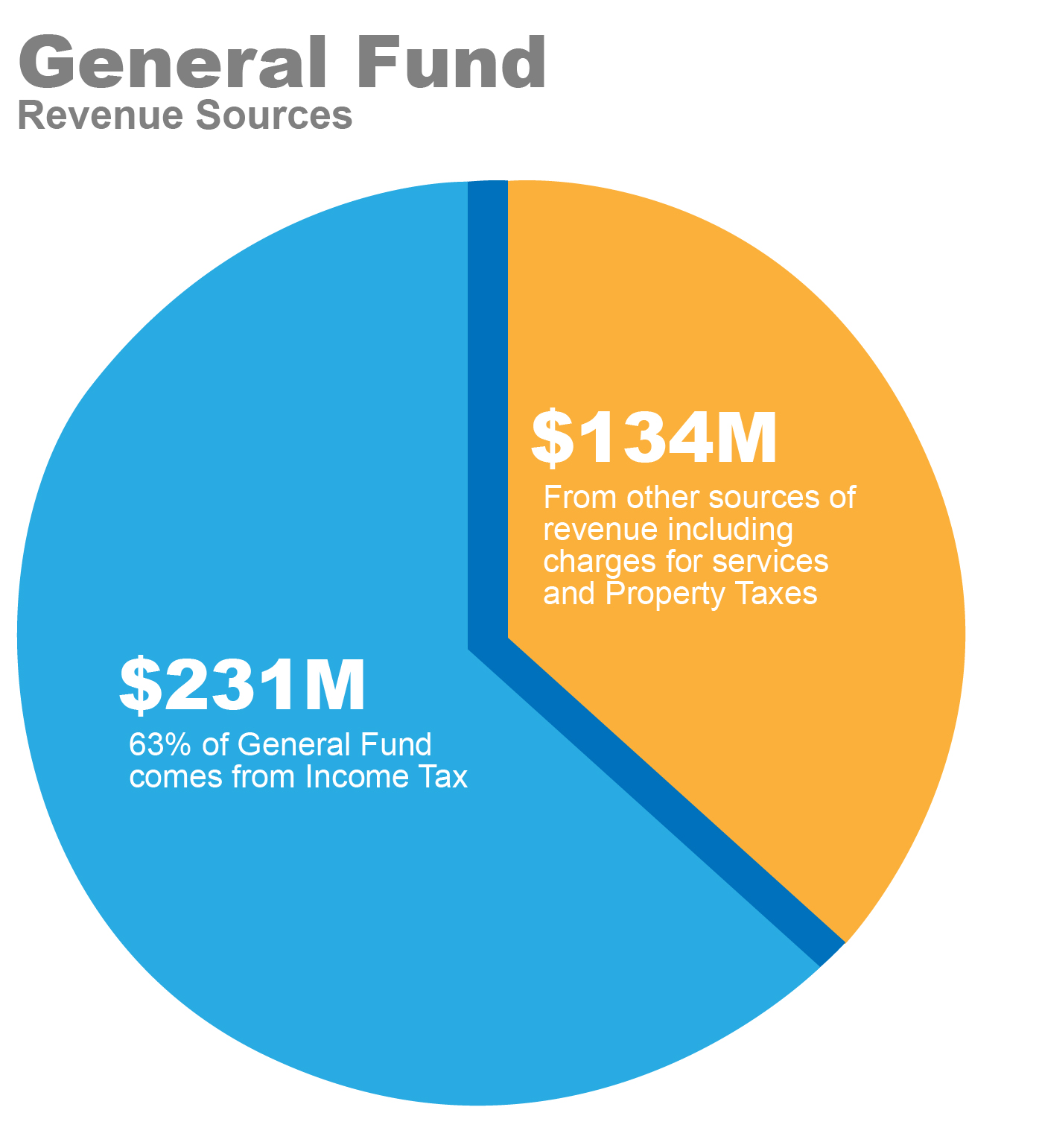

Changes in the General Fund

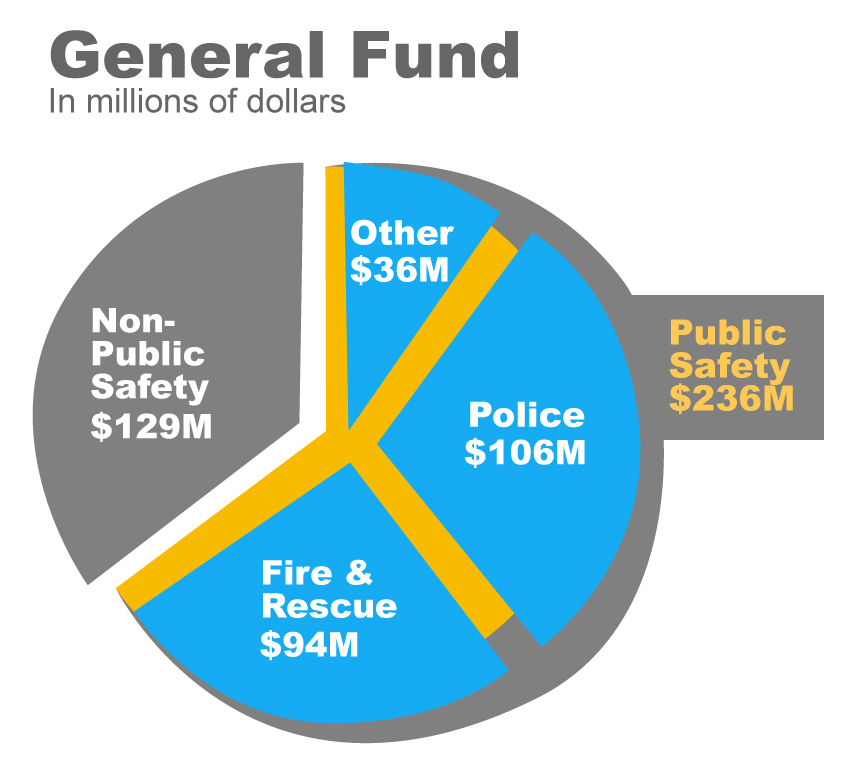

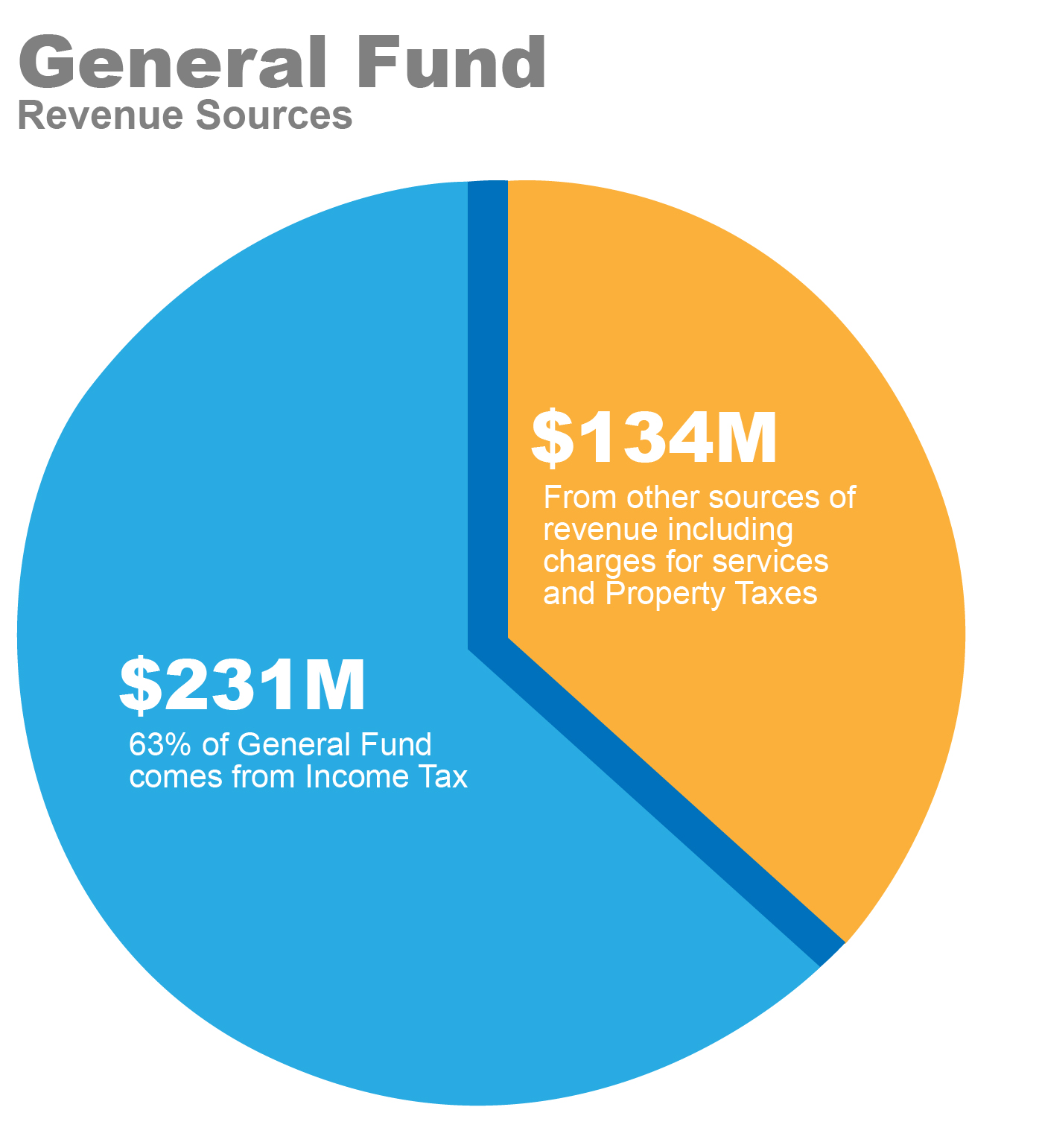

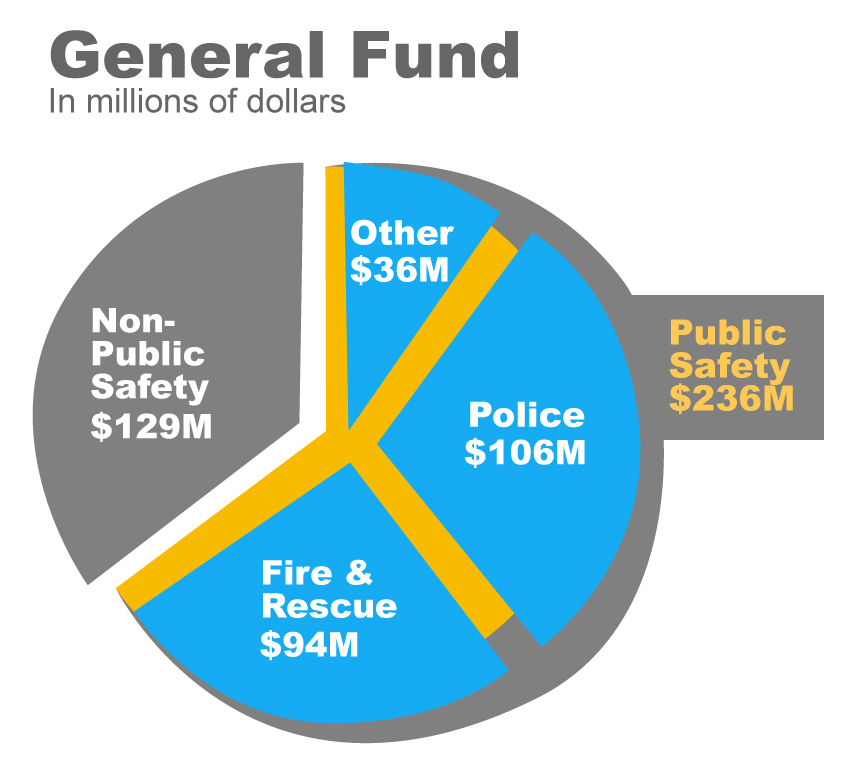

The total proposed expenditures for the General Fund — the part of the budget that deals with most community-based services in Toledo — is $365,231,389.

This figure is up about $30 million, 9 percent from last year’s budget, and last year’s budget was up 8 percent from the previous year’s budget in 2023.

City financial planners estimate an increase in the budget to $375 million in 2026, and further stabilization of spending afterwards.

Summarizing the spending in the General Fund was councilman George Sarantou. He said that “police, fire and the courts are priority in this budget, as they always have been.”

A majority of the General Fund is allocated to the fire and police departments, who alone make up $200,903,482 – or 55 percent – of the total General Fund, up from 51 percent last year.

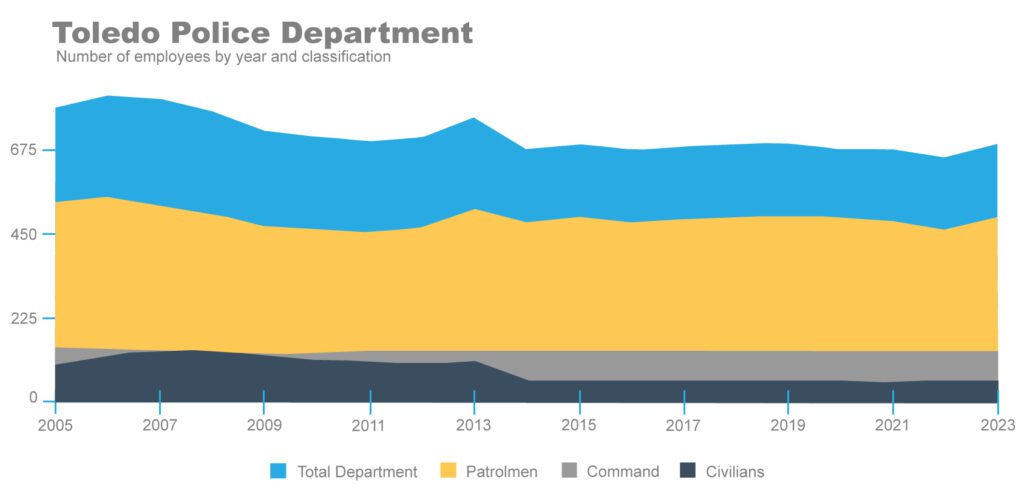

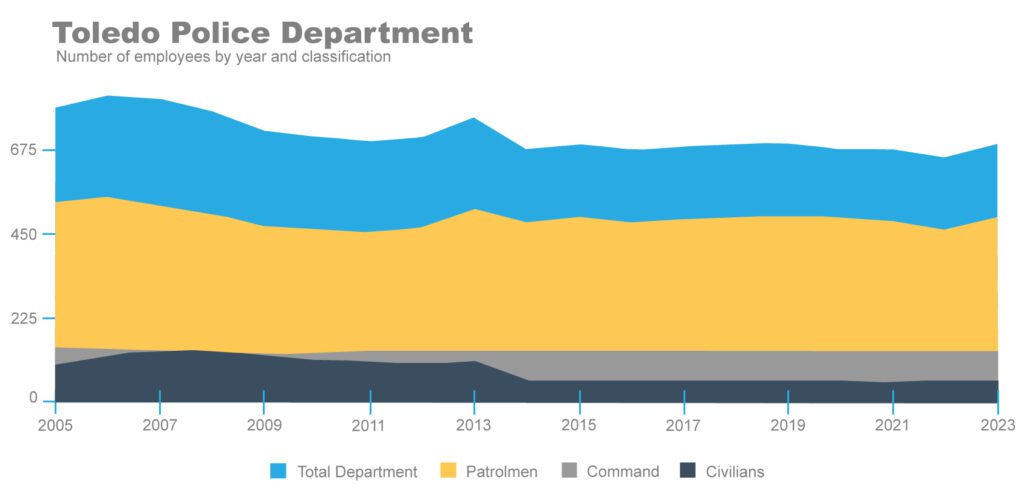

Proudly, Kapszukiewicz declared that he has “grown the size of the police force,” during his tenure as mayor.

“Actually, the previous administrations had sort of used it [the police force], as a budget-saving mechanism. And so by the time I became mayor, the size of the police force was down to about 585,” he added.

The personnel department within the Toledo Police Department (TPD), which handles matters related to employee recruitment, told the Free Press in early January that they had 584 sworn officers (not civilians) on hand, but are expecting 28 new police officers from a class that graduated on Jan. 17. By the end of January Toledo should have 612 police officers.

2023’s annual police report summary documented 628 total police officers with 492 patrolmen.

The increased Public Safety Department budget, which contains the Police and Fire & Rescue departments, can almost solely account for the increase in spending in the new budget.

In 2024, the Public Safety budget was $205 million, and the newly proposed one is $236 million.

Kapszukiewicz was hoping to add a police class of 30, but in the final approved budget this turned into 45. Along with the new police officers a class of 20 firefighters will be added, but it is unclear if this is maintaining or growing the departments.

The new police class of 45, should be ready to start by the end of March, but the proposed budget said, “The Toledo Police Department does not currently have any new positions in the 2025 budget.”

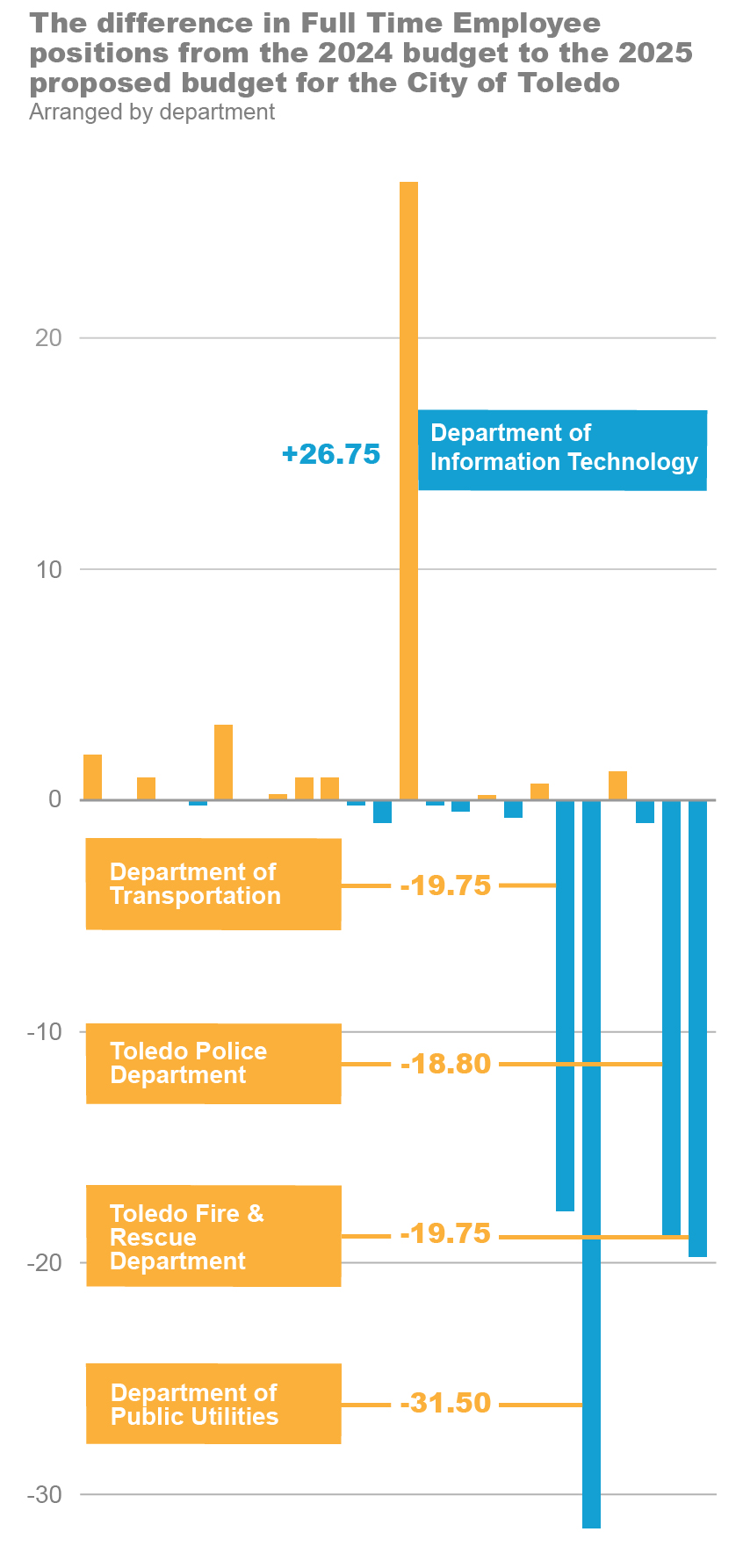

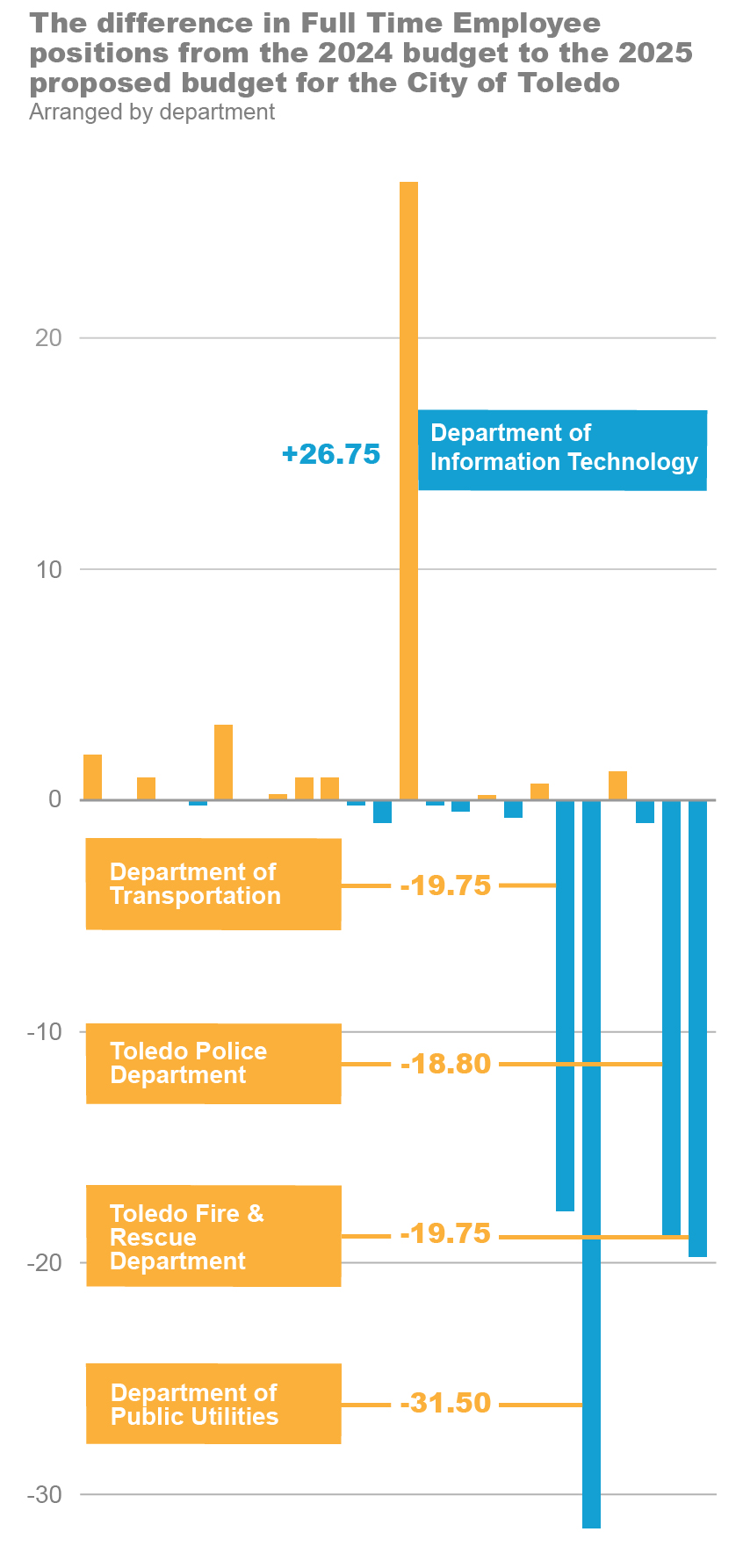

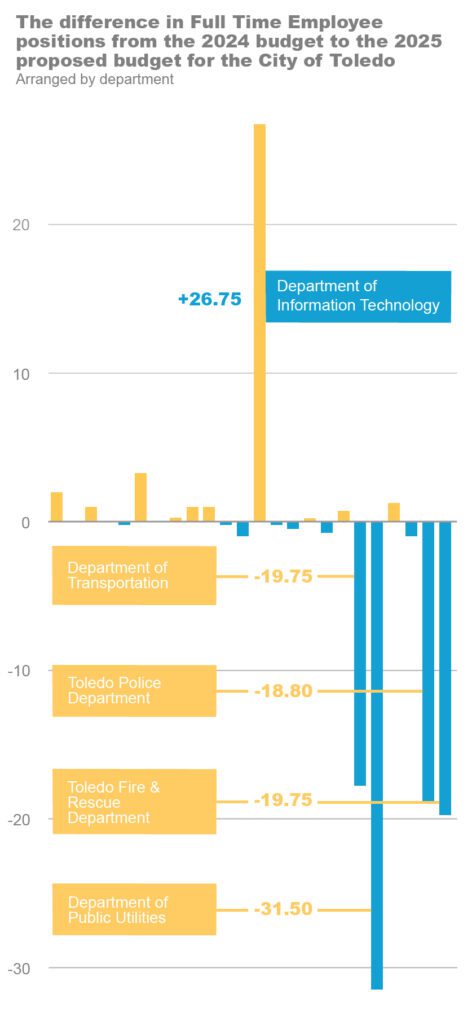

In the proposed budget -18.8 full-time employee (FTE) positions, were lost from the previous year. It can be assumed, with adding 15 police officers on top of the proposed budget, this number could now be -3.8 FTEs. Regardless, the proposed budget said the added $8.95 million was put in place to make up for lost subsidized ARPA funding and the 4 percent raise to all city employees.

“There’s a lot of reasons our crime has gone down,” Kapszukiewicz noted. “One of them [the reasons] is that we’ve grown the size of the police force so that there are more officers able to do the community policing and foot patrols that we think work.”

High crime? Low crime?

Crime has dropped dramatically since 2021, a record year for violent crime across many communities, including Toledo. TPD reported 68 homicides that year, and last year TPD reported 37 homicides, roughly on par with pre-pandemic rates of homicide in the city.

“What we’ve seen in Toledo, our results are better than the average city. So, for instance, from 2022 to 2023…you’re right, homicides went down by 10 percent in American cities, but in Toledo, they went down by 30 percent,” Kapszukiewicz said.

According to the Council on Criminal Justice (CCJ), who gets their data from the Federal Bureau of Investigation (FBI) and the Bureau of Justice Statistics (BJS), “The number of homicides in the 29 cities providing data for that crime [homicide] was 13 percent lower,” from 2023 to 2024, noting a national downward trend in crime.

Data based on the first six months of 2024 – per a report from the CCJ (see Link 1) – appears to roughly put the average rate of homicide for these 29 cities – which include Atlanta, Boston, Buffalo, Chicago, Denver, Detroit, Louisville, New York, Philadelphia, Syracuse and more – roughly at 17 homicides per 100,000 people a year.

The average rate of homicide for a city the size of Toledo can roughly be calculated to about 45 homicides a year across the country, roughly 17.77 percent less than the average of the cities.

Unfortunately, when looking at the broader data for non-lethal crime, aggravated assault statistics in particular, a figure that was missing from Kapszukiewicz and Police Chief Michael Troendle’s press event on Jan. 15, have consistently been far above the average nationally.

Data provided by TPD in 2023 showed a total of 2,426 aggravated assaults in Toledo, and the estimated average rate for 2023 across the 29 cities presented by the CCJ was 557.8 assaults per 100,000 people. Adjusted for Toledo’s population of 265,000 people, the city would be on par if it was at 1,478 aggravated assaults.

However, the rate of aggravated assault is 64 percent higher than the average across the cities culled, and the rate of violent crime in Toledo when compared to non-cities is more than double.

Regardless, compared to its pandemic highs, Toledo is improving its crime statistics and getting back to pre-pandemic numbers.

Further investments in the police include $2.75 million from the Capital Improvement Fund for procuring equipment for police, and $850,000 is allocated towards the Fire & Rescue Department.

The class of 20 firefighters is slated to start their academy training in August, and the Fire & Rescue Department contains 602.15 FTEs in the budget spreadsheet. This represents -19.75 FTEs from 2024.

The largest expense for both police and fire departments is labor (See Figure 3).

TOLEDO – Not as openly touted in the budget were the additional positions added to the Department of Information Technology (IT), a full 26.75 FTEs (full-time equivalent).

This includes more than double the previous year’s Engage Toledo positions, up to 34 FTEs from 12.5 in 2024.

“The budgeted FTEs for IT have increased compared to the 2024 budget due to the consolidation of the Engage Toledo Call Center with the Department of Public Utilities call center,” the budget summary explained, helping shine light on the 31.5 FTEs taken from the Department of Public Utilities.

The Department of Information Technology’s added 26.75 FTEs at the expense of the Department of Public Utilities’ loss of 31.5 FTEs accounts for the largest FTE changes in the budget, and also puts in perspective the boast of eliminating 55 government positions.

Total FTEs for the 2025 year are 2,990.43, which constitutes -54.30 from the previous year, but bear in mind that 26.75 FTEs of the 34 Public Utility Call Center were added back to the budget in a different department.

“We eliminated 55 vacant positions in our budget,” Kapszukiewicz told the Free Press. “In other words, if these positions were being funded and weren’t filled, that kind of told us that the service wasn’t, maybe, essential.

“So, we eliminated the funding for those positions, which saved money, freed up money. That is a sign of, I think, good budgeting,” he added.

The elimination of those positions put Toledo in a position to receive $60 million in savings by the end of 2025.

“The city’s long-term goal is to maintain a fund balance reserve of approximately two months’ of operating expense in the General Fund,” the budget states.

Moves like these are what Kapszukiewicz believes led to the city’s improved bond rating (something akin to a credit score for cities), which was improved by Moody’s to an A2 rating, and Standard and Poor increased their rating to an A from an A-.

“Standard and Poor (S&P) and Moody’s [Analytics CRE] don’t care about politics; they just care about the nuts and bolts, and for them to bless our budget the way they did, I think should give citizens confidence that we’re moving in the right direction,” noted Kapszukiewicz.

Funding, generally

Other funds on the books:

- Capital Fund budget of $81.4 million

- A roads budget of $27 million

- A capital improvement to general fund transfer of $24 million

- An across-the-board 4 percent wage increase for all Toledo city employees, not just police and firefighters.

Not every comparison is one-to-one, but many of the challenges Toledo faces are similar to Detroit’s and other cities, whose economies relied heavily on manufacturing.

These challenges include, but aren’t limited to, declining populations, the decline of the manufacturing industry, higher crime rates and the persistence of blight, all problems that require extra funds to tackle.

Of that total of $365 million in the General Fund, $231,303,710 comes directly from Toledo citizens’ income taxes, and this is the main revenue used by the City of Toledo to fund the General Fund.

Currently, Toledo charges a 2.5 percent income tax, higher than most of the surrounding suburbs who charge between 1.5 percent to 2.25 percent income tax rates.

“Our income tax collections are as high as they’ve ever been. If we were facing economic peril, that wouldn’t be the case,” said Kapszukiewicz about the total amount of income tax taken in, not the rate.

Comparatively, the city of Detroit’s income tax rate is 2.4 percent, and their property tax rate is 2.24 percent to Toledo’s 2.43 percent property tax rate. Detroit received $892,898,710 for their population of 633K in their general fund from “taxes, assessments and interest,” which is roughly 60 percent greater revenue per-person in spite of their lower tax percentages.

Detroit’s allocation would be about $592 million instead of their $892 million if they collected revenue like Toledo does.

Considering Detroit’s 33 percent poverty rate to Toledo’s 24 percent, and Toledo’s $45,000 yearly median income to the Census Bureau’s reported $39,000 median income for Detroiters, it’s clear Detroit receives a different source of taxable revenue to supplement their expenses.

Work with what you’ve got

In defense of the budget, the mayor has said that “Toledo doesn’t have a spending problem; it has a revenue problem.”

Detroit fills out their General Fund with taxes it gets from a “recurring wagering tax” on retail and internet sports betting. Detroit expects to gross $282.6 million in taxes in 2025 from sports betting alone. In 2020, the wagering tax only grossed $130 million, but since then, including last year, the tax on sports betting has pulled in upwards of $250 million, more than Toledo’s entire income tax revenue.

Morally questionable to some, betting may not be ideal, but the results are clear: Taxes on betting pay off. And a considerable amount of the betting doesn’t require a physical location, as the wagering tax collected $158 million from Detroit’s three casinos last year and a separate $106 million from online sports betting.

Toledo’s position in Ohio makes it more difficult for the city to benefit from a wagering tax, as the state itself taxes betting, splitting the majority of the tax revenue between Ohio’s 88 counties. As a host city of betting, due to the Hollywood Casino, Toledo would only be able to receive 5 percent of the total taxes taken in by a wagering tax.

If Ohio’s tax system was applied to Detroit, it would only receive $12.5 million of $250 million it would regularly gross.

Regardless, Detroit did much more than tax betting to bring in money, and also pursued grants to invest in its city, as Toledo has. Decades of work in Detroit has paid off.

“For the first time since 1957, the city of Detroit is growing again — not Wayne County — the city of Detroit,” Kapszukiewicz emphasized.

On their website, the City of Detroit lists these accomplishments as the behind-the-scenes work leading to the recent growth in the Motor City, all of which require heavy funding and investment.

- $1 billion invested in more than 4,600 units of affordable housing over the past five years

- Job growth with more than 25,000 more Detroiters employed since 2014

- A return to investment-grade bond status for the first time since 2009

- $3 billion in added wealth for Detroit’s Black homeowners since 2014, according to a University of Michigan study

- Reductions in crime, beating national trends, including the fewest homicides in 57 years

- Successfully hosting the largest ever NFL Draft at 775,000 people in over three days

The fight against blight

Along with these steps, Detroit has actively fought blight aggressively in their city for decades.

“Blight removal is critical to the resurgence of cities across Michigan,” said U.S. Sen. Gary Peters, (D-Mich.), in a Detroit Free Press article.

Likewise, U.S. Sen. Debbie Stabenow, (D-Mich.), said in 2016, ahead of a federal allocation to remove blight, that “we have the most sophisticated blight removal program in the country.”

Quality housing and a healthy job market are the two key factors Rachel Blakeman, director of Purdue University Fort Wayne’s Community Research Institute, said were keys to Fort Wayne’s recent growth.

Growth in Fort Wayne has been noticed by the U.S. Census Bureau, who labeled Fort Wayne as the fastest growing large city in the Midwest, and in 2022, Fort Wayne surpassed Toledo’s population for the first time.

“Since Fort Wayne hasn’t annexed in any statistically meaningful way in many years, this growth is organic – either by more people moving into the city or more babies being born – rather than a redrawing of the city limits,” Blakeman said in a quote touted on the city of Fort Wayne’s website.

These population increases are the product of a myriad of factors, but one common factor between both Detroit and Fort Wayne is an annual governmental allocation by both cities to deal with blight.

An “Unsafe Building Fund” was established in the early 2020s, and last year Fort Wayne gave $2,970,646 to oversee. According to the Fort Wayne budget: “The repair or demolition of those buildings which are dilapidated, substandard, or unfit for human habitation and which constitute a hazard to the health, safety, and welfare of the citizens of the City…”

In the upcoming year, the Indiana city set aside $2,487,205 for the fund, and Detroit approved a plan to do likewise with $34.2 million in their Blight Fund.

Local housing efforts

Toledo’s main organization dealing with property remediation is the Lucas County Land Bank, whose CEO spoke on some of the housing challenges in Toledo.

“We have a very old neighborhood housing stock,” said David Mann, CEO and president of the Land Bank. “The average age of a house built in Toledo is built before 1940.

“Anything that old is going to need ongoing maintenance, and because of a lack of wealth in our community, because of challenges over the last generation, much of that housing stock has not been maintained in the way that it needs to,” he added.

In the Economic Development part of the 2025 budget – a $28.5 million grant for Reconnecting Communities and Neighborhoods from the U.S. Department of Transportation to make street improvements to Front and Main Streets in East Toledo, adjacent to the ongoing Metroparks Toledo Riverwalk projects – is cited as a means for providing safer, better connected and “more visually appealing” streetscape for east Toledo; however, there isn’t a concise plan to deal with this aging housing stock in Toledo.

“By using data analytics to identify and prioritize blighted properties, engaging community members in the process, and being more cost-effective than traditional approaches, cities such as Detroit, Baltimore, and New Orleans have been able to reduce blight rates, and therefore reduce the associated negative impacts, while revitalizing the local community,” wrote Natalia Gulick De Torres, a graduate student at the Harvard Graduate School of Design and research assistant for Data-Smart City Solutions, in an article titled Cities Are Not Overbuilt, But Underdemolished: Data-Driven Strategies for Blight Removal.

Negative impacts of blight are many, including reticence for business investors, heightened crime rates, (in some cases) heightened health risks, lower property values and lower revenues overall for the community.

The Lucas County Land Bank approaches blight by demolishing properties that are too far gone, renovating properties themselves or handing the properties over to people to renovate them on a timeline.

A percentage of delinquent property taxes serves as the land bank’s most reliable funding source.

“It’s a mechanism that only exists in Ohio,” Mann said, and explained that “Ohio county land banks are able to access a portion of the penalty and interest, so, last year, that was about $1.7 million. After that, we either generate the income ourselves through the work that we do, or we compete for grants.

“We are a piece of the puzzle at the Land Bank … but I don’t want to pretend to you that the $1.7 million that we have access to a year is anything close to what’s needed to actually meet the community’s overall needs,” Mann said.

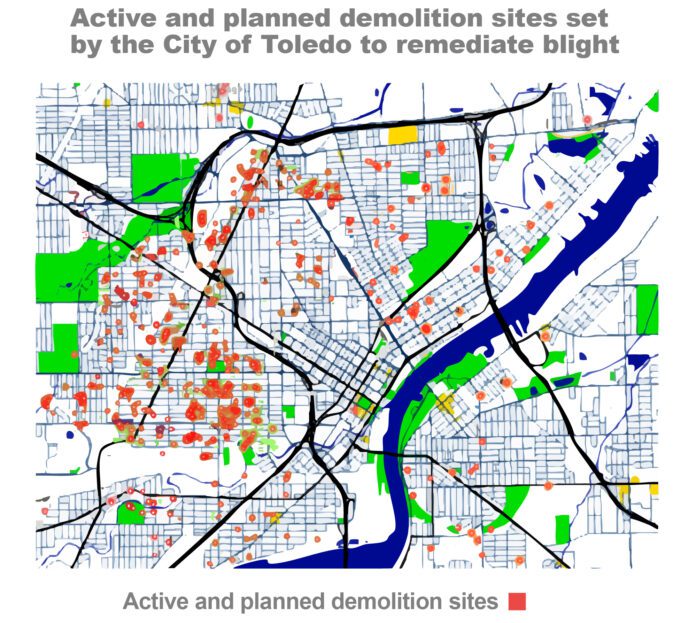

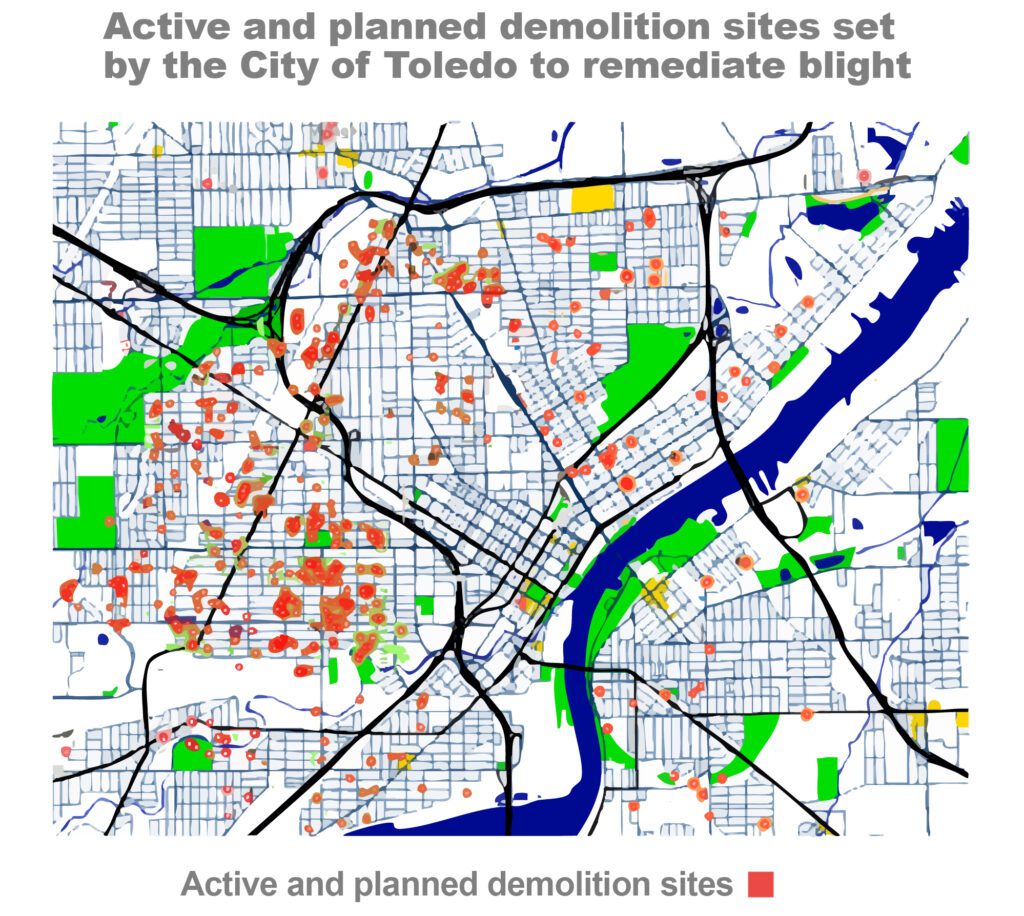

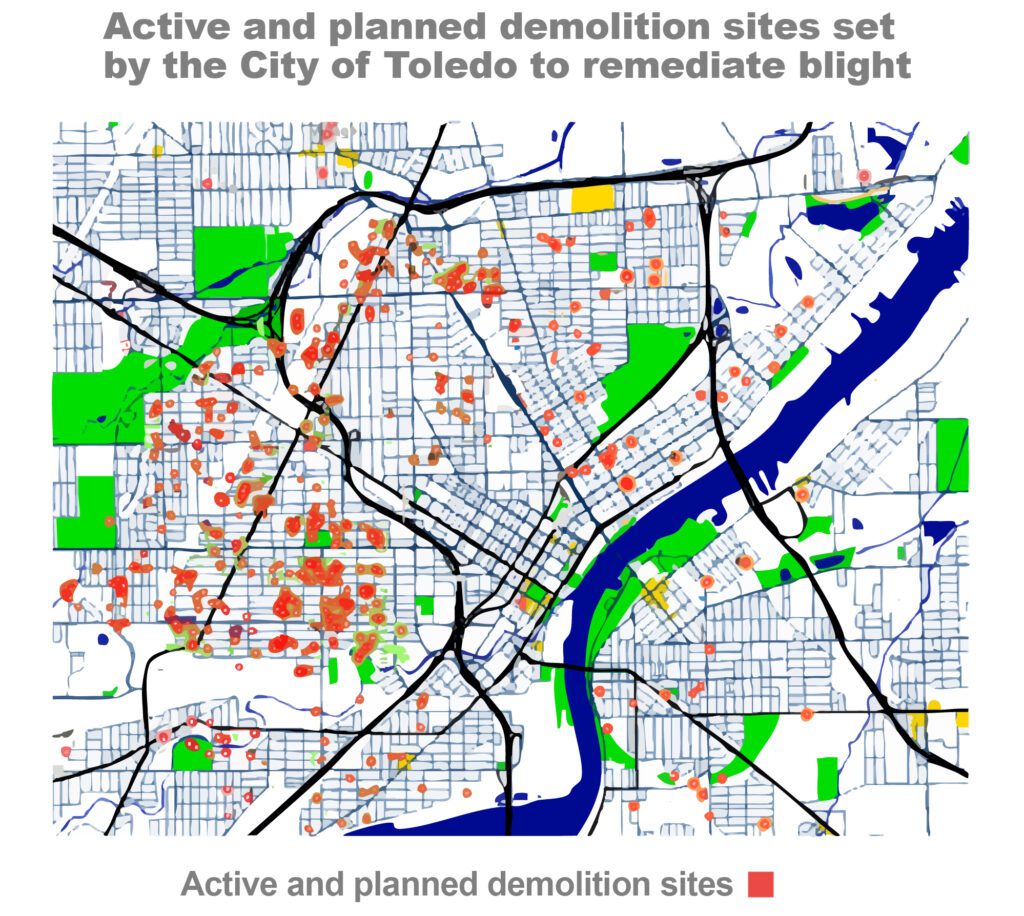

The division of Urban Beautification houses the city of Toledo’s demolition program, which currently has 491 properties planned or actively in process of demolition. Most of these demolitions fall into the City of Toledo’s Districts 1, 3 and 4, most heavily concentrated in the Junction and Englewood neighborhoods, but are fairly present in many neighborhoods surrounding downtown, uptown and the Warehouse District.

“All of this is very, very, very expensive,” Mann said, referring to the process of building, renovating or demolishing housing. “Because housing is just very expensive by its nature, but making these kinds of investments now means that even though they’re expensive, this is as cheap as it’s ever going to get.

“If we continue to defer some of these challenges for another decade, well, they’ll be way more expensive 10 years from now,” he reasoned.

With better housing, it’s likely Toledo’s crime rate will drop, and with better housing and safer neighborhoods, it’s likely companies will invest.

“Our neighborhoods will be more stable if we can continue to invest in maintaining and preserving what is already here. It was very expensive to build this community out over the last 100 years, and the cheapest way for us to continue to support it is to make continued investments in that,” Mann said.

The renovation of east Toledo streets and the Glass Center of Excellence, supported by a $31.3 million grant, are the two main economic development projects outlined in the 2025 budget, approved by Toledo City Council on Jan. 28.

The center will be “Ohio’s first innovation hub,” according to Gov. Mike DeWine’s website, and will “build on Toledo’s legacy as the ‘Glass Capital of the World’ to accelerate innovation and job growth in both the glass sector and solar industry, which relies heavily on glass.”

Unfortunately for Toledo, the center will be built in Perrysburg instead of the actual Glass City.

“The DeWine-Husted [Ohio governor and Lt. governor] Administration developed the Ohio Innovation Hubs Program in partnership with the Ohio General Assembly last year to spur investment outside Ohio’s major metro areas,” the governor’s website states.

“I do think Toledo will benefit,” Toledo Mayor Wade Kapszukiewicz said. “They could have picked any city, and they picked Toledo first,” for the first innovation hub.

Kapszukiewicz said that regardless of the location of businesses, the city will benefit if Toledoans hold jobs with the center. But incentives are unclear as to why someone should move into the city of Toledo when compared with moving into one of the many suburbs available.

Blight, crime and higher taxes are enough to push many people away from settling inside the city, especially when businesses seem to be comfortable settling in places like Maumee and Perrysburg.

Business in Toledo

Without new major investments from companies, Toledo seems to be stymied and struggling to maintain its current real estate.

Toledo experienced massive growth at the turn of the 20th century, with major investments from Willys-Overland, which would eventually become Jeep. In 1918, the first Jeep factory was the second largest auto manufacturing factory in the world, competing with Detroit’s auto industry contributions.

By 1925, 41 percent of all income in Toledo came from Jeep.

Kapszukiewicz has often said in press conferences and on his podcast, Wednesdays with Wade, “Toledo’s big business is small business.”

However, small businesses have been struggling in Toledo, and part of this struggle is undoubtedly the declining population.

Just in the waning months of 2024 into the new year, the Ottawa Tavern closed; The Flying Joe’s downtown Toledo location closed; Toledo Spirits closed; Heavy Brewing closed; and Three Dog Bakery closed their Toledo location, while both The Flying Joe and Three Dog Bakery are continuing operations in Perrysburg, a suburb that has seen consistent gradual population growth for the past 30 years.

Hopes are high for how Metroparks Toledo will cultivate economic investment with their Riverwalk, but the riverwalk echoes some of the traits of an earlier attempt cultivate investment through preparing a nice space.

Portside Festival Marketplace was Toledo’s attempt during the ’80s to create an aesthetically pleasing hub for smaller businesses along the Maumee River in Downtown Toledo.

“Toledo’s new marketplace was envisioned as the catalyst for downtown’s rebirth, and Rouse [the company that invested in the marketplace] asserted that it would have ‘a transforming impact for Toledo,’” from the book, Lost Toledo by David Yonke.

This project was met with swift decline.

The marketplace opened in 1984, plagued with criticisms about its parking and a very high-interest rate on the mortgage of the building. People were not interested in traveling into town to shop when they already lived in the suburbs with their own shopping centers, and by 1990 the marketplace was closed.

Later, the building was turned into COSI and now the Imagination Station, currently a thriving nonprofit, but not a business center providing economic lift to the city.

Try, try again

Another more recent blunder for Toledo dealt with the hopes placed on the Fresno, Calif. company, Bitwise, which promised to move into the Jefferson Center, providing real economic support to the city through job training and creation.

Unfortunately, Bitwise imploded in 2023 and the owners pleaded guilty to an over a $100 million fraud scheme.

Making the best of an imperfect situation, Kapszukiewicz told the Free Press to watch what businesses move into the newly renovated Jefferson Center, although nothing is confirmed for now. Had Bitwise held up their part of the deal, Toledo’s economic development may have dynamically improved.

Local community member, Chris Hanley, pastor for Glenwood Lutheran Church, applauded Kapszukiewicz for his work in trying to spin Toledo as “on the up and up” during the Toledo Ambassador Academy program, but he also looks back on when he first heard of the Bitwise deal.

“I remembered thinking, ‘This seems too good to be true,’” he recalled.

The main challenges Toledo faces are in remediating blight, crime and securing major investments in the city to fix its revenue problem. Parks are highlighted by Toledo hopefuls as a means to bring people into the city, but more substantial incentives are required when the suburbs offer better housing, better tax rates and safer neighborhoods.

Perhaps the most substantial step forward in the new budget are the newly secured bond ratings and the stabilization fund of $60 million, which will allow the city to borrow with better interest rates.

The continued building of the IT Department for the city shows promise, especially with Engage Toledo doubling its numbers and moving many of the city’s services online and into a more convenient package.

But until the city can find a solution to its revenue problem, it will continue to work overtime on securing grants to bring money back into the city, something it has done very well.

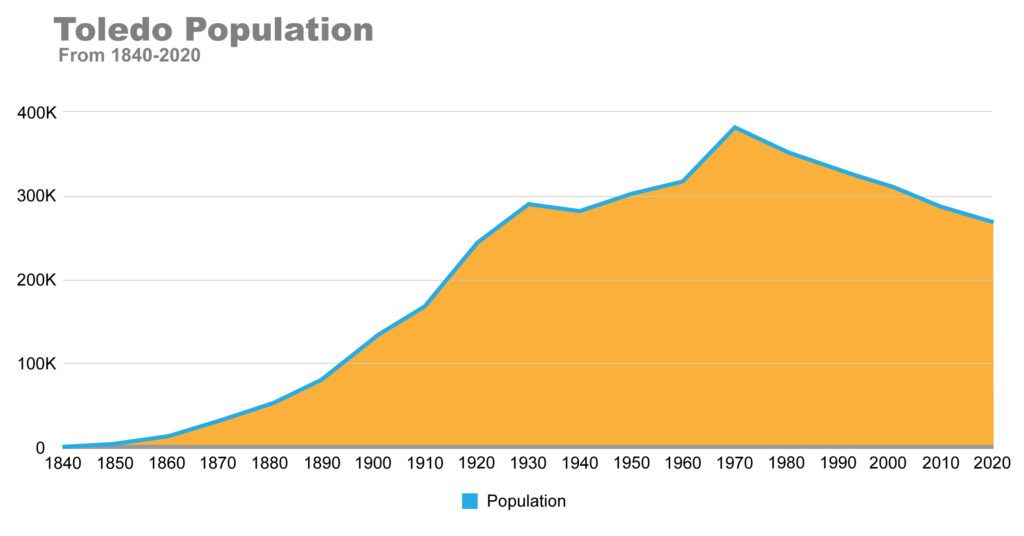

Without a greater pace of restoration, Toledo’s population will continue to decline.

Population in Toledo declines by roughly 10,000 people every five years. From 2015 to 2020, the decline was 280,000 to 270,000, and before then, some of the decline was more severe. The most recent record for Toledo’s population was in 2023, where Toledo was estimated to have a population around 265,000.

With a new Republican president in office, it’s unclear what kind of money the city can expect to receive from the federal government, but, historically, it is unlikely Toledo will receive anything like a second round of American Rescue Plan Act (ARPA) funds.

“These are absolutely uncertain times,” Kapszukiewicz said. “No one ever knows what the future is going to hold.

Potential for the future

Late 2025 is the rough estimate for the opening of the Gordie Howe International Bridge, a six-lane border crossing connecting the United States and Canada and leading straight into I-75. An incredible amount of potential exists for further economic development in Toledo, as this connection to Canada will substantially improve international trade.

2024 ended with a bad taste for one of Toledo’s most iconic employers, Jeep, who threatened to layoff 1,100 workers, but then backtracked this move in December.

President Donald Trump‘s largely publicized tariffs may have influenced Stellantis’s [Jeep’s parent corporation] choice to keep jobs in Ohio, as the president has been saying he will put a 25 percent general tariff on Canadian and Mexican goods.

It is unclear if Trump will follow through on his tariff plans, but there are fears that a general flat rate tariff would be detrimental to both the Canadian and northern United States economies.

“The United States and Canada are each other’s largest trading partners, for almost everything,” said Gregory Gardner, a professor of economics at SUNY Potsdam, in an article from North Country Public Radio (NCPR). Gardner said there have been disputes between the U.S. and Canada concerning trade in the past, but called the flat rate 25 percent tariff a, “nuclear strike on trade.”

Any changes to the negotiations could lead to different outcomes, including lowered tariff percentages, more specifically tariffed goods over a flat-rate tariff or any number of other concessions. But for now, Toledo will have to wait to see how it pans out.

“It is prudent to be cautious and conservative and to try to position your budget and your city in the best possible way for whatever the future holds,” Kapszukiewicz said. “I think this budget does that again. We, at the end of this year, will have a $60 million rainy day fund to help prepare us for that rainy day, if a rainy day comes.”

Kapszukiewicz has cast his vision effectively to shake off the “rustbelt” labels associated with Toledo, especially through the Ambassador Academy program, and continues to think positively.

“I think Toledo is ready to grow,” he said, and highlighted Detroit, Buffalo and Cincinnati as cities with recent growth. “If those cities can do it, Toledo can do it.”

Amendments to the proposed budget

Before the end of January, on the 28th, Toledo City Council added these following changes to the budget and approved it.

- Additional $1 million for Youth Programming Funding

- Additional $200,000 for Vibrancy Initiative Funding

- Increase Police Class from 30 to 45 Cadets

- $50,000 City of Toledo Sponsorship of the 2025 Toledo Glass City JazzFest

Other parts of the budget must have been changed, because the proposed budget total was higher than the approved budget’s total. All expenditures for the proposed budget maxed out at $1,006,300,819, and the approved budget, with seemingly added expenses, was less at $1,001,872,882.

Special Report: Pt. 3 | Examining Toledo’s 2025 budget

Part 3 | The Budget Breakdown: This is the final of a 3-part story. This story looks into the proposed 2025 budget for the City of Toledo.

> Read the entire story here.

TOLEDO – The renovation of east Toledo streets and the Glass Center of Excellence, supported by a $31.3 million grant, are the two main economic development projects outlined in the 2025 budget, approved by Toledo City Council on Jan. 28.

The center will be “Ohio’s first innovation hub,” according to Gov. Mike DeWine’s website, and will “build on Toledo’s legacy as the ‘Glass Capital of the World’ to accelerate innovation and job growth in both the glass sector and solar industry, which relies heavily on glass.”

Unfortunately for Toledo, the center will be built in Perrysburg instead of the actual Glass City.

“The DeWine-Husted [Ohio governor and Lt. governor] Administration developed the Ohio Innovation Hubs Program in partnership with the Ohio General Assembly last year to spur investment outside Ohio’s major metro areas,” the governor’s website states.

“I do think Toledo will benefit,” Toledo Mayor Wade Kapszukiewicz said. “They could have picked any city, and they picked Toledo first,” for the first innovation hub.

Kapszukiewicz said that regardless of the location of businesses, the city will benefit if Toledoans hold jobs with the center. But incentives are unclear as to why someone should move into the city of Toledo when compared with moving into one of the many suburbs available.

Blight, crime and higher taxes are enough to push many people away from settling inside the city, especially when businesses seem to be comfortable settling in places like Maumee and Perrysburg.

Business in Toledo

Without new major investments from companies, Toledo seems to be stymied and struggling to maintain its current real estate.

Toledo experienced massive growth at the turn of the 20th century, with major investments from Willys-Overland, which would eventually become Jeep. In 1918, the first Jeep factory was the second largest auto manufacturing factory in the world, competing with Detroit’s auto industry contributions.

By 1925, 41 percent of all income in Toledo came from Jeep.

Kapszukiewicz has often said in press conferences and on his podcast, Wednesdays with Wade, “Toledo’s big business is small business.”

However, small businesses have been struggling in Toledo, and part of this struggle is undoubtedly the declining population.

Just in the waning months of 2024 into the new year, the Ottawa Tavern closed; The Flying Joe’s downtown Toledo location closed; Toledo Spirits closed; Heavy Brewing closed; and Three Dog Bakery closed their Toledo location, while both The Flying Joe and Three Dog Bakery are continuing operations in Perrysburg, a suburb that has seen consistent gradual population growth for the past 30 years.

Hopes are high for how Metroparks Toledo will cultivate economic investment with their Riverwalk, but the riverwalk echoes some of the traits of an earlier attempt cultivate investment through preparing a nice space.

Portside Festival Marketplace was Toledo’s attempt during the ’80s to create an aesthetically pleasing hub for smaller businesses along the Maumee River in Downtown Toledo.

“Toledo’s new marketplace was envisioned as the catalyst for downtown’s rebirth, and Rouse [the company that invested in the marketplace] asserted that it would have ‘a transforming impact for Toledo,’” from the book, Lost Toledo by David Yonke.

This project was met with swift decline.

The marketplace opened in 1984, plagued with criticisms about its parking and a very high-interest rate on the mortgage of the building. People were not interested in traveling into town to shop when they already lived in the suburbs with their own shopping centers, and by 1990 the marketplace was closed.

Later, the building was turned into COSI and now the Imagination Station, currently a thriving nonprofit, but not a business center providing economic lift to the city.

Try, try again

Another more recent blunder for Toledo dealt with the hopes placed on the Fresno, Calif. company, Bitwise, which promised to move into the Jefferson Center, providing real economic support to the city through job training and creation.

Unfortunately, Bitwise imploded in 2023 and the owners pleaded guilty to an over a $100 million fraud scheme.

Making the best of an imperfect situation, Kapszukiewicz told the Free Press to watch what businesses move into the newly renovated Jefferson Center, although nothing is confirmed for now. Had Bitwise held up their part of the deal, Toledo’s economic development may have dynamically improved.

Local community member, Chris Hanley, pastor for Glenwood Lutheran Church, applauded Kapszukiewicz for his work in trying to spin Toledo as “on the up and up” during the Toledo Ambassador Academy program, but he also looks back on when he first heard of the Bitwise deal.

“I remembered thinking, ‘This seems too good to be true,'” he recalled.

The main challenges Toledo faces are in remediating blight, crime and securing major investments in the city to fix its revenue problem. Parks are highlighted by Toledo hopefuls as a means to bring people into the city, but more substantial incentives are required when the suburbs offer better housing, better tax rates and safer neighborhoods.

Perhaps the most substantial step forward in the new budget are the newly secured bond ratings and the stabilization fund of $60 million, which will allow the city to borrow with better interest rates.

The continued building of the IT Department for the city shows promise, especially with Engage Toledo doubling its numbers and moving many of the city’s services online and into a more convenient package.

But until the city can find a solution to its revenue problem, it will continue to work overtime on securing grants to bring money back into the city, something it has done very well.

Without a greater pace of restoration, Toledo’s population will continue to decline.

Population in Toledo declines by roughly 10,000 people every five years. From 2015 to 2020, the decline was 280,000 to 270,000, and before then, some of the decline was more severe. The most recent record for Toledo’s population was in 2023, where Toledo was estimated to have a population around 265,000.

With a new Republican president in office, it’s unclear what kind of money the city can expect to receive from the federal government, but, historically, it is unlikely Toledo will receive anything like a second round of American Rescue Plan Act (ARPA) funds.

“These are absolutely uncertain times,” Kapszukiewicz said. “No one ever knows what the future is going to hold.

Potential for the future

Late 2025 is the rough estimate for the opening of the Gordie Howe International Bridge, a six-lane border crossing connecting the United States and Canada and leading straight into I-75. An incredible amount of potential exists for further economic development in Toledo, as this connection to Canada will substantially improve international trade.

2024 ended with a bad taste for one of Toledo’s most iconic employers, Jeep, who threatened to layoff 1,100 workers, but then backtracked this move in December.

President Donald Trump‘s largely publicized tariffs may have influenced Stellantis’s [Jeep’s parent corporation] choice to keep jobs in Ohio, as the president has been saying he will put a 25 percent general tariff on Canadian and Mexican goods.

It is unclear if Trump will follow through on his tariff plans, but there are fears that a general flat rate tariff would be detrimental to both the Canadian and northern United States economies.

“The United States and Canada are each other’s largest trading partners, for almost everything,” said Gregory Gardner, a professor of economics at SUNY Potsdam, in an article from North Country Public Radio (NCPR). Gardner said there have been disputes between the U.S. and Canada concerning trade in the past, but called the flat rate 25 percent tariff a, “nuclear strike on trade.”

Any changes to the negotiations could lead to different outcomes, including lowered tariff percentages, more specifically tariffed goods over a flat-rate tariff or any number of other concessions. But for now, Toledo will have to wait to see how it pans out.

“It is prudent to be cautious and conservative and to try to position your budget and your city in the best possible way for whatever the future holds,” Kapszukiewicz said. “I think this budget does that again. We, at the end of this year, will have a $60 million rainy day fund to help prepare us for that rainy day, if a rainy day comes.”

Kapszukiewicz has cast his vision effectively to shake off the “rustbelt” labels associated with Toledo, especially through the Ambassador Academy program, and continues to think positively.

“I think Toledo is ready to grow,” he said, and highlighted Detroit, Buffalo and Cincinnati as cities with recent growth. “If those cities can do it, Toledo can do it.”

Special Report: Pt. 2 | Examining Toledo’s 2025 budget

Part 2 | The Budget Breakdown: This is a 3-part story that looks into the 2025 budget for the City of Toledo, passed by Toledo City Council on Jan. 28

> Read the entire story here.

> Continued from Part 1 <

TOLEDO – Not as openly touted in the budget were the additional positions added to the Department of Information Technology (IT), a full 26.75 FTEs (full-time equivalent).

This includes more than double the previous year’s Engage Toledo positions, up to 34 FTEs from 12.5 in 2024.

“The budgeted FTEs for IT have increased compared to the 2024 budget due to the consolidation of the Engage Toledo Call Center with the Department of Public Utilities call center,” the budget summary explained, helping shine light on the 31.5 FTEs taken from the Department of Public Utilities.

The Department of Information Technology’s added 26.75 FTEs at the expense of the Department of Public Utilities’ loss of 31.5 FTEs accounts for the largest FTE changes in the budget, and also puts in perspective the boast of eliminating 55 government positions.

Total FTEs for the 2025 year are 2,990.43, which constitutes -54.30 from the previous year, but bear in mind that 26.75 FTEs of the 34 Public Utility Call Center were added back to the budget in a different department.

“We eliminated 55 vacant positions in our budget,” Kapszukiewicz told the Free Press. “In other words, if these positions were being funded and weren’t filled, that kind of told us that the service wasn’t, maybe, essential.

“So, we eliminated the funding for those positions, which saved money, freed up money. That is a sign of, I think, good budgeting,” he added.

The elimination of those positions put Toledo in a position to receive $60 million in savings by the end of 2025.

“The city’s long-term goal is to maintain a fund balance reserve of approximately two months’ of operating expense in the General Fund,” the budget states.

Moves like these are what Kapszukiewicz believes led to the city’s improved bond rating (something akin to a credit score for cities), which was improved by Moody’s to an A2 rating, and Standard and Poor increased their rating to an A from an A-.

“Standard and Poor (S&P) and Moody’s [Analytics CRE] don’t care about politics; they just care about the nuts and bolts, and for them to bless our budget the way they did, I think should give citizens confidence that we’re moving in the right direction,” noted Kapszukiewicz.

Funding, generally

Other funds on the books:

- Capital Fund budget of $81.4 million

- A roads budget of $27 million

- A capital improvement to general fund transfer of $24 million

- An across-the-board 4 percent wage increase for all Toledo city employees, not just police and firefighters.

Not every comparison is one-to-one, but many of the challenges Toledo faces are similar to Detroit’s and other cities, whose economies relied heavily on manufacturing.

These challenges include, but aren’t limited to, declining populations, the decline of the manufacturing industry, higher crime rates and the persistence of blight, all problems that require extra funds to tackle.

Of that total of $365 million in the General Fund, $231,303,710 comes directly from Toledo citizens’ income taxes, and this is the main revenue used by the City of Toledo to fund the General Fund.

Currently, Toledo charges a 2.5 percent income tax, higher than most of the surrounding suburbs who charge between 1.5 percent to 2.25 percent income tax rates.

“Our income tax collections are as high as they’ve ever been. If we were facing economic peril, that wouldn’t be the case,” said Kapszukiewicz about the total amount of income tax taken in, not the rate.

Comparatively, the city of Detroit’s income tax rate is 2.4 percent, and their property tax rate is 2.24 percent to Toledo’s 2.43 percent property tax rate. Detroit received $892,898,710 for their population of 633K in their general fund from “taxes, assessments and interest,” which is roughly 60 percent greater revenue per-person in spite of their lower tax percentages.

Detroit’s allocation would be about $592 million instead of their $892 million if they collected revenue like Toledo does.

Considering Detroit’s 33 percent poverty rate to Toledo’s 24 percent, and Toledo’s $45,000 yearly median income to the Census Bureau’s reported $39,000 median income for Detroiters, it’s clear Detroit receives a different source of taxable revenue to supplement their expenses.

Work with what you’ve got

In defense of the budget, the mayor has said that “Toledo doesn’t have a spending problem; it has a revenue problem.”

Detroit fills out their General Fund with taxes it gets from a “recurring wagering tax” on retail and internet sports betting. Detroit expects to gross $282.6 million in taxes in 2025 from sports betting alone. In 2020, the wagering tax only grossed $130 million, but since then, including last year, the tax on sports betting has pulled in upwards of $250 million, more than Toledo’s entire income tax revenue.

Morally questionable to some, betting may not be ideal, but the results are clear: Taxes on betting pay off. And a considerable amount of the betting doesn’t require a physical location, as the wagering tax collected $158 million from Detroit’s three casinos last year and a separate $106 million from online sports betting.

Toledo’s position in Ohio makes it more difficult for the city to benefit from a wagering tax, as the state itself taxes betting, splitting the majority of the tax revenue between Ohio’s 88 counties. As a host city of betting, due to the Hollywood Casino, Toledo would only be able to receive 5 percent of the total taxes taken in by a wagering tax.

If Ohio’s tax system was applied to Detroit, it would only receive $12.5 million of $250 million it would regularly gross.

Regardless, Detroit did much more than tax betting to bring in money, and also pursued grants to invest in its city, as Toledo has. Decades of work in Detroit has paid off.

“For the first time since 1957, the city of Detroit is growing again — not Wayne County — the city of Detroit,” Kapszukiewicz emphasized.

On their website, the City of Detroit lists these accomplishments as the behind-the-scenes work leading to the recent growth in the Motor City, all of which require heavy funding and investment.

- $1 billion invested in more than 4,600 units of affordable housing over the past five years

- Job growth with more than 25,000 more Detroiters employed since 2014

- A return to investment-grade bond status for the first time since 2009

- $3 billion in added wealth for Detroit’s Black homeowners since 2014, according to a University of Michigan study

- Reductions in crime, beating national trends, including the fewest homicides in 57 years

- Successfully hosting the largest ever NFL Draft at 775,000 people in over three days

The fight against blight

Along with these steps, Detroit has actively fought blight aggressively in their city for decades.

“Blight removal is critical to the resurgence of cities across Michigan,” said U.S. Sen. Gary Peters, (D-Mich.), in a Detroit Free Press article.

Likewise, U.S. Sen. Debbie Stabenow, (D-Mich.), said in 2016, ahead of a federal allocation to remove blight, that “we have the most sophisticated blight removal program in the country.”

Quality housing and a healthy job market are the two key factors Rachel Blakeman, director of Purdue University Fort Wayne’s Community Research Institute, said were keys to Fort Wayne’s recent growth.

Growth in Fort Wayne has been noticed by the U.S. Census Bureau, who labeled Fort Wayne as the fastest growing large city in the Midwest, and in 2022, Fort Wayne surpassed Toledo’s population for the first time.

“Since Fort Wayne hasn’t annexed in any statistically meaningful way in many years, this growth is organic – either by more people moving into the city or more babies being born – rather than a redrawing of the city limits,” Blakeman said in a quote touted on the city of Fort Wayne’s website.

These population increases are the product of a myriad of factors, but one common factor between both Detroit and Fort Wayne is an annual governmental allocation by both cities to deal with blight.

An “Unsafe Building Fund” was established in the early 2020s, and last year Fort Wayne gave $2,970,646 to oversee. According to the Fort Wayne budget: “The repair or demolition of those buildings which are dilapidated, substandard, or unfit for human habitation and which constitute a hazard to the health, safety, and welfare of the citizens of the City…”

In the upcoming year, the Indiana city set aside $2,487,205 for the fund, and Detroit approved a plan to do likewise with $34.2 million in their Blight Fund.

Local housing efforts

Toledo’s main organization dealing with property remediation is the Lucas County Land Bank, whose CEO spoke on some of the housing challenges in Toledo.

“We have a very old neighborhood housing stock,” said David Mann, CEO and president of the Land Bank. “The average age of a house built in Toledo is built before 1940.

“Anything that old is going to need ongoing maintenance, and because of a lack of wealth in our community, because of challenges over the last generation, much of that housing stock has not been maintained in the way that it needs to,” he added.

In the Economic Development part of the 2025 budget – a $28.5 million grant for Reconnecting Communities and Neighborhoods from the U.S. Department of Transportation to make street improvements to Front and Main Streets in East Toledo, adjacent to the ongoing Metroparks Toledo Riverwalk projects – is cited as a means for providing safer, better connected and “more visually appealing” streetscape for east Toledo; however, there isn’t a concise plan to deal with this aging housing stock in Toledo.

“By using data analytics to identify and prioritize blighted properties, engaging community members in the process, and being more cost-effective than traditional approaches, cities such as Detroit, Baltimore, and New Orleans have been able to reduce blight rates, and therefore reduce the associated negative impacts, while revitalizing the local community,” wrote Natalia Gulick De Torres, a graduate student at the Harvard Graduate School of Design and research assistant for Data-Smart City Solutions, in an article titled Cities Are Not Overbuilt, But Underdemolished: Data-Driven Strategies for Blight Removal.

Negative impacts of blight are many, including reticence for business investors, heightened crime rates, (in some cases) heightened health risks, lower property values and lower revenues overall for the community.

The Lucas County Land Bank approaches blight by demolishing properties that are too far gone, renovating properties themselves or handing the properties over to people to renovate them on a timeline.

A percentage of delinquent property taxes serves as the land bank’s most reliable funding source.

“It’s a mechanism that only exists in Ohio,” Mann said, and explained that “Ohio county land banks are able to access a portion of the penalty and interest, so, last year, that was about $1.7 million. After that, we either generate the income ourselves through the work that we do, or we compete for grants.

“We are a piece of the puzzle at the Land Bank … but I don’t want to pretend to you that the $1.7 million that we have access to a year is anything close to what’s needed to actually meet the community’s overall needs,” Mann said.

The division of Urban Beautification houses the city of Toledo’s demolition program, which currently has 491 properties planned or actively in process of demolition. Most of these demolitions fall into the City of Toledo’s Districts 1, 3 and 4, most heavily concentrated in the Junction and Englewood neighborhoods, but are fairly present in many neighborhoods surrounding downtown, uptown and the Warehouse District.

“All of this is very, very, very expensive,” Mann said, referring to the process of building, renovating or demolishing housing. “Because housing is just very expensive by its nature, but making these kinds of investments now means that even though they’re expensive, this is as cheap as it’s ever going to get.

“If we continue to defer some of these challenges for another decade, well, they’ll be way more expensive 10 years from now,” he reasoned.

With better housing, it’s likely Toledo’s crime rate will drop, and with better housing and safer neighborhoods, it’s likely companies will invest.

“Our neighborhoods will be more stable if we can continue to invest in maintaining and preserving what is already here. It was very expensive to build this community out over the last 100 years, and the cheapest way for us to continue to support it is to make continued investments in that,” Mann said.

Part 3 | The Budget Breakdown continues Jan. 31.

Special Report: Pt. 1 | Examining Toledo’s 2025 budget

Part 1 | The Budget Breakdown: This is a 3-part story that looks into the 2025 budget for the City of Toledo, passed by Toledo City Council on Jan. 28 .

> Read the entire story here.

TOLEDO – Vision casting for the new year is not lost on local governments, as plans and funding need to be approved in their yearly budgets.

In November, Mayor Wade Kapszukiewicz presented his 2025 budget to Toledo City Council, who had until the end of March to make changes and approve the 212-page document. City council passed it on Jan. 28.

The 2025 city budget completes the transition off of American Rescue Plan Act (ARPA) funds, while maintaining current operations, eliminates 55 Full Time Employee (FTE) positions in the budget, and allowed for saving $60 million by the end of 2025, leading to an increased bond rating for the City of Toledo.

Economic development plans in the budget focus on a new Glass Center of Excellence, based in Perrysburg that will bring in more jobs, and renovating east Toledo streets surrounding the Glass City Riverwalk. Toledo’s main challenges remain finding enough money to invest in remediating blight or poorly maintained areas, lowering crime rates, attracting future investments within the city and reversing Toledo’s chronic population decline.

According to Kapszukiewicz, this new budget invests further in public safety, including a 4 percent raise for government employees, roads, community initiatives and a sizable “rainy-day” fund.

Breaking down the total budget

About $1 billion was proposed for the entire city budget, which is down by about half a billion dollars from last year. The main cuts to the overall budget were made in the following sections:

- Enterprise ($526M to $317M)

- Special Revenue ($294M to $94M)

- Capital Projects ($276M to $111M)

The Toledo Free Press will be diving into these numbers in the future, but part of the reason for this drop-off is supplemental grant funding.

Melanie Campbell, the interim finance director, clarified that the 2024 budget included grants and capital projects that are in process, which can span multiple years.

One such grant are the funds associated with the American Rescue Plan Act (ARPA).

“In 2020 and 2021, the federal government made a historic level of investment in local governments and local communities, a level we haven’t seen since the Great Depression,” said Simon Nyi, the grants commissioner for the City of Toledo. “And Toledo has done a good job of getting our fair share of that money.”

In total, Toledo received $180.9 million in ARPA funds in 2021, on par with much larger cities, like Columbus, Ohio, which received $187 million in ARPA funds.

“The numbers make it clear that on a per-capita basis, we have been among the most successful cities in Ohio at securing these grant dollars, and we’ve been succeeding at a level comparable to much larger cities nationwide; there is no question that we’re ‘punching above our weight,’” Nyi said when referring to the total amount of grants Toledo received (not just ARPA).

Projects funded with ARPA include afterschool programs, parks projects and — most prominently — $19 million of the $28.7 million for the up-and-coming Wayman D. Palmer YMCA in the Warren-Sherman neighborhood, a neighborhood Kapszukiewicz said has been overlooked for years.

ARPA funds will be spent into 2026, but had to be obligated, not just budgeted, before the end of 2024. All ARPA funds must be spent by the end of 2026.

Changes in the General Fund

The total proposed expenditures for the General Fund — the part of the budget that deals with most community-based services in Toledo — is $365,231,389.

This figure is up about $30 million, 9 percent from last year’s budget, and last year’s budget was up 8 percent from the previous year’s budget in 2023.

City financial planners estimate an increase in the budget to $375 million in 2026, and further stabilization of spending afterwards.

Summarizing the spending in the General Fund was councilman George Sarantou. He said that “police, fire and the courts are priority in this budget, as they always have been.”

A majority of the General Fund is allocated to the fire and police departments, who alone make up $200,903,482 – or 55 percent – of the total General Fund, up from 51 percent last year.

Proudly, Kapszukiewicz declared that he has “grown the size of the police force,” during his tenure as mayor.

“Actually, the previous administrations had sort of used it [the police force], as a budget-saving mechanism. And so by the time I became mayor, the size of the police force was down to about 585,” he added.

The personnel department within the Toledo Police Department (TPD), which handles matters related to employee recruitment, told the Free Press in early January that they had 584 sworn officers (not civilians) on hand, but are expecting 28 new police officers from a class that graduated on Jan. 17. By the end of January Toledo should have 612 police officers.

2023’s annual police report summary documented 628 total police officers with 492 patrolmen.

The increased Public Safety Department budget, which contains the Police and Fire & Rescue departments, can almost solely account for the increase in spending in the new budget.

In 2024, the Public Safety budget was $205 million, and the newly proposed one is $236 million.

Kapszukiewicz is hoping to add a police class of 30 and a class of 20 firefighters, but it’s unclear if this is maintaining or growing the departments.

The budget details the new police class of 30 should be ready to start by the end of March, and reads, “The Toledo Police Department does not currently have any new positions in the 2025 budget.”

In fact, the budget details a net -18.8 full-time employee (FTE) positions, and explains the added $8.95 million to their budget is to keep pace with previous year’s allocations subsidized by ARPA funding, as well as the 4 percent raise to all city employees.

“There’s a lot of reasons our crime has gone down,” Kapszukiewicz noted. “One of them [the reasons] is that we’ve grown the size of the police force so that there are more officers able to do the community policing and foot patrols that we think work.”

High crime? Low crime?

Crime has dropped dramatically since 2021, a record year for violent crime across many communities, including Toledo. TPD reported 68 homicides that year, and last year TPD reported 37 homicides, roughly on par with pre-pandemic rates of homicide in the city.

“What we’ve seen in Toledo, our results are better than the average city. So, for instance, from 2022 to 2023…you’re right, homicides went down by 10 percent in American cities, but in Toledo, they went down by 30 percent,” Kapszukiewicz said.

According to the Council on Criminal Justice (CCJ), who gets their data from the Federal Bureau of Investigation (FBI) and the Bureau of Justice Statistics (BJS), “The number of homicides in the 29 cities providing data for that crime [homicide] was 13 percent lower,” from 2023 to 2024, noting a national downward trend in crime.

Data based on the first six months of 2024 – per a report from the CCJ (see Link 1) – appears to roughly put the average rate of homicide for these 29 cities – which include Atlanta, Boston, Buffalo, Chicago, Denver, Detroit, Louisville, New York, Philadelphia, Syracuse and more – roughly at 17 homicides per 100,000 people a year.

The average rate of homicide for a city the size of Toledo can roughly be calculated to about 45 homicides a year across the country, roughly 17.77 percent less than the average of the cities.

Unfortunately, when looking at the broader data for non-lethal crime, aggravated assault statistics in particular, a figure that was missing from Kapszukiewicz and Police Chief Michael Troendle’s press event on Jan. 15, have consistently been far above the average nationally.

Data provided by TPD in 2023 showed a total of 2,426 aggravated assaults in Toledo, and the estimated average rate for 2023 across the 29 cities presented by the CCJ was 557.8 assaults per 100,000 people. Adjusted for Toledo’s population of 265,000 people, the city would be on par if it was at 1,478 aggravated assaults.

However, the rate of aggravated assault is 64 percent higher than the average across the cities culled, and the rate of violent crime in Toledo when compared to non-cities is more than double.

Regardless, compared to its pandemic highs, Toledo is improving its crime statistics and getting back to pre-pandemic numbers.

Further investments in the police include $2.75 million from the Capital Improvement Fund for procuring equipment for police, and $850,000 is allocated towards the Fire & Rescue Department.

The class of 20 firefighters is slated to start their academy training in August, and the Fire & Rescue Department contains 602.15 FTEs in the budget spreadsheet. This represents -19.75 FTEs from 2024.

The largest expense for both police and fire departments is labor (See Figure 3).