As the year winds down and a new one begins, it’s easy to plan for transition here in Northwest Ohio. The leaves have fallen and everyone knows it is time to get ready for the next season.

Similarly, it is often at the end or beginning of the year that many people choose to retire. If you are wondering if you can retire and what the steps to success are, the process isn’t always easy as planning for the weather.

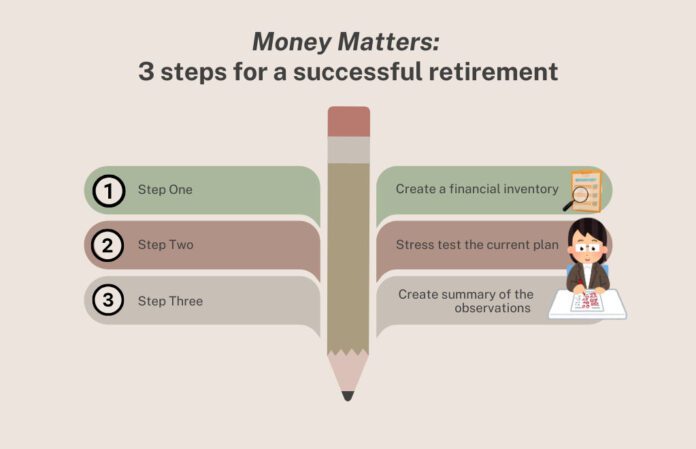

Here are three simple steps to help guide the transition:

Step 1. Create a financial inventory. This will be helpful in gathering a clear picture of the current situation. This summary should include financial assets, debts and insurance coverages. Then identify the income sources.

This would include social security, pension, annuity and any other work income if one spouse plans to continue to work. Clarify the income goals for retirement. Think in terms of minimum monthly income needs, plus discretionary spending on travel and hobbies, and then add 20 percent for unknown expenses.

Step 2. Stress test the current plan. Using a tool called a Monte Carlo simulation will tell the possible outcomes of retirement success. This tool will be helpful to identify issues on why the plan could fail, such as a major market decline, higher taxes, or a long-term health care crisis.

If the outcome is 90 percent probability of success or higher, that is great news. If below 90 percent, to increase the probability of success, review how to make retirement dollars work harder, consider different retirement spending strategies, or look at ways to optimize income.

Step 3. Write down a summary of the observations. As someone who has guided hundreds of retirees, I often identify opportunities and threats when I go through steps one and two. To get organized and everything accomplished, create a written checklist of the items to work on.

Break down those observations into tax strategies, estate planning, asset protection, and money management. For example, if the plan is to retire before the age of 65, reviewing affordable healthcare should be put on the checklist. This is now the working blueprint on getting retirement ready.

By following these three steps, you will have a foundation to get through retirement with relative ease. This clarity and checklist can help reduce the stress of retirement and turn it into the next exciting season of life.

For more information about America’s Retirement Headquarters, tune in every Saturday at 12 PM on 1370 WSPD or visit www.arhq.com. Investment Advisory Services are offered through The Retirement Guys Formula, LLC. Securities are offered through PEAK Brokerage Services LLC., Member FINRA / SIPC. America’s Retirement Headquarters and Retirement Guys Formula is not an affiliate of PEAK Brokerage Services LLC. The office is at 1700 Woodlands Drive, Suite 100, Maumee, OH 43537. 419-842-0550