Nueva Esperanza Community Credit Union empowers Latino community

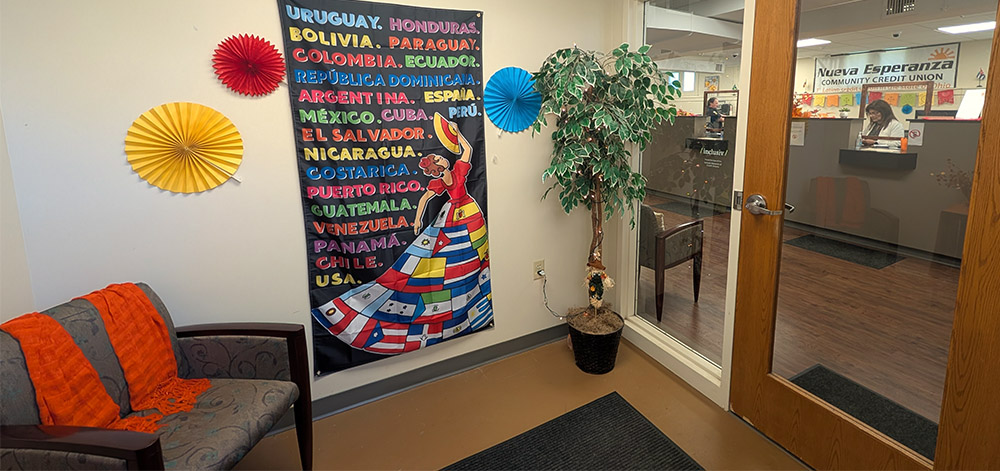

TOLEDO – Located in the heart of Toledo’s south side on Broadway St., Nueva Esperanza Community Credit Union (NECCU) is making cultural history while financially empowering local residents.

As Ohio’s first and only Latino credit union, NECCU has been serving its members since 2010. Under the guidance of president and CEO Sue Cuevas, it has not only grown, it continues to thrive, reflecting the resilience and determination of the community it represents.

Identifying the need

The creation of the federally insured, state-chartered credit union was spurred by a deep-seated need within the Toledo community to address major gaps in financial services, particularly for the Latino population.

“There was a group of Hispanic leaders and business owners who noticed the prevalence of check cashing places and predatory lending targeting the Hispanic community,” Cuevas said. “There was no place where they could go to a financial institution and have someone help them, guide them or instruct them,” she said.

That’s when Cuevas took action. “I wanted to guide them, show them and teach them that it’s not okay to pay unreasonable interest rates just because they don’t have credit,” she explained.

Financial empowerment for the Latino community

For the past 14 years, Cuevas has grown NECCU, which now boasts over 625 members across its Toledo and Columbus locations, with assets approaching $3 million, all while pursuing a mission to promote savings, enhance financial literacy, provide loan capital, and link members with vital community resources.

“Our goal is not just to offer financial products, but to educate and uplift our members,” she added. “We want to instill confidence in our members that they can build their own credit.”

Serving a primarily Latino membership—though everyone is welcome — the credit union offers a comprehensive range of financial services, as well as traditional checking accounts, including savings accounts, loans and reloadable Visa cards.

In fact, the Ending with the Heart program starts members with a $500 credit-building loan to help establish credit after making consecutive on-time payments for 12 months, enabling them to make larger purchases while feeling confident and comfortable.

Cuevas says members have great success with this program. “I’ve seen them start with $500 and come in and ask for an $8,000 to $10,000 personal loan, and they’re going to get it.”

“Yvette Villanueva and her husband, Jose Carlos Padilla have been members for 10 years. Villanueva said, “We have had several loans through NECCU that have not only helped us personally, but also contributed to the success of our small business.”

Villanueva and Padilla take advantage of several offerings from NECCU, including a savings account, personal loans and auto loans for their businesses.

“I do not believe we would have had the growth we’ve had these last five years without the support of Sue and NECCU. What we like most about being a member is the friendly staff and having people that truly understand the struggles that minorities and small businesses face,” she added.

The Challenges and the Future

Cuevas acknowledges that the journey hasn’t been without its challenges; it took nearly seven years before the National Credit Union Administration and the Ohio Department of Financial Institutions authorized NECCU as a start-up.

With a small yet dedicated team of two part-time employees in Toledo and a part-time assistant in Columbus, the credit union staff plays a crucial role in day-to-day operations, and in building trust within the community. Cuevas has managed to juggle multiple roles herself, including being a bank secrecy act officer, a teller and a loan officer, ensuring all quarterly and annual reports are completed.

Looking into the future, Cuevas hopes for expansion in some capacity while making certain that current members and new ones receive the same dedicated service. “Credit unions are about people helping people; it’s our duty to inform and make people aware.”

“Everybody has a way of helping people in the community, and there’s not a right way or wrong way. It’s just how we serve in our communities that makes a lasting impact,” she said.

For more information, visit the Toledo branch at 1638 Broadway St., lower level, or their website at Nueva Esperanza Community Credit Union.