Prohibition to progress: The absurdity of U.S. cannabis policy

In one part of the country, cannabis entrepreneurs are cutting ribbons on new dispensaries, generating millions in tax revenue and employing thousands. In others, people are handcuffed and booked for carrying a few grams of the same plant.

In Washington, Congress debates cannabis reform endlessly. Meanwhile, Wall Street is already cashing in. The federal government profits off cannabis through unfair tax laws but refuses to legalize it.

This is the absurdity of America’s cannabis policy in 2025, where legal cannabis businesses fuel booming economies, yet people are still arrested every day for simple possession.

It’s time to move beyond this contradiction and establish a rational, national approach to cannabis regulation.

The economic boom: Cannabis is fueling growth

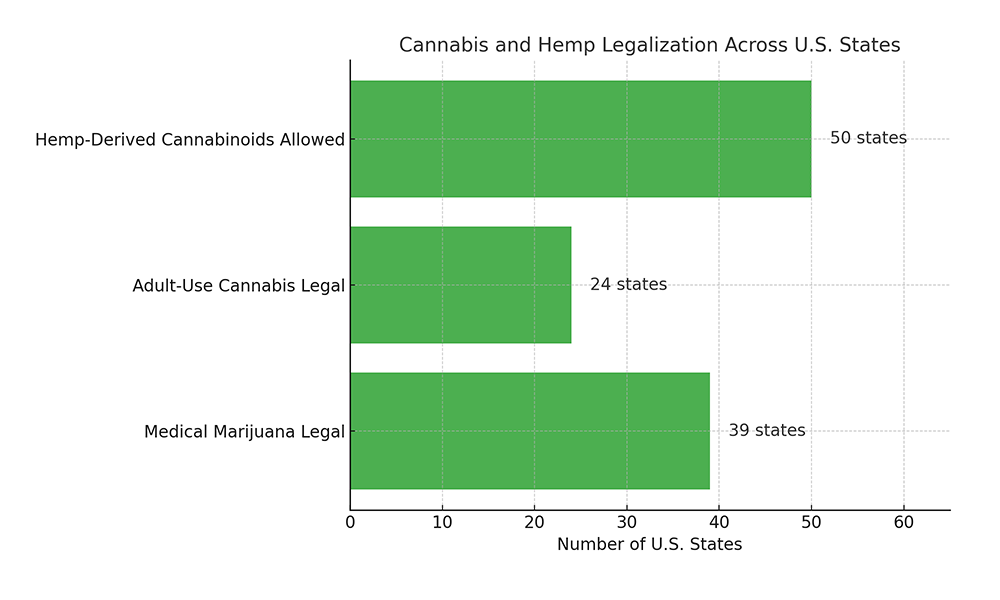

Cannabis is no longer an underground market—it’s a major economic force (See graphic 1):

States that have legalized cannabis are thriving. Colorado, Illinois and California have all surpassed $1 billion in cannabis tax revenue and are funding schools, drug treatment programs and law enforcement.

Meanwhile, the federal government continues to block the industry from fully participating in the economy, denying businesses access to banking, capital and fair tax treatment, all while collecting more taxes from cannabis businesses than any other industry because of 280E.

There’s a deep and troubling hypocrisy at the heart of federal cannabis policy: While the government classifies cannabis as a Schedule I drug—on par with heroin—it is simultaneously profiting off its legal sale through a punitive tax code.

Under Section 280E of the federal tax code, cannabis businesses are prohibited from deducting ordinary business expenses, like rent, payroll and marketing. This results in effective tax rates of 40 to 80 percent, compared to the standard corporate rate of 21 percent.

A 2019 ITEP report estimated 280E adds an effective 6.25 percent federal tax burden to cannabis sales. Based on the size of the U.S. cannabis market—projected at over $45 billion annually—this translates to an estimated $5.5 billion in federal tax revenue from businesses that can’t even open a bank account.

Let’s be clear: these aren’t criminal cartels. These are licensed, tax-paying businesses that comply with state regulations. And yet, they’re being taxed like criminals while the federal government reaps the benefits.

Uncle Sam is America’s most profitable, protected and hypocritical drug dealer.

They want the money, not the policy: The Ohio case study

Even in states that have legalized cannabis, political hypocrisy continues to rear its head.

In Ohio, voters passed adult-use cannabis in November 2023 by a wide margin. However, Gov. Mike DeWine’s administration is actively pushing to double the marijuana sales tax from 10 to 20 percent, despite the fact that voters approved this figure. The proposal, included in the governor’s budget, would dramatically increase the financial burden on Ohio’s cannabis consumers and businesses to fund law enforcement priorities, without expanding access or reducing regulatory friction.

At the same time, Ohio regulators continue to delay the rollout of cannabis pre-rolls, one of the most in-demand and profitable product categories in every adult-use market. These delays are not based on public health concerns or product safety—they are political decisions that undermine the market voters approved.

Ohio isn’t alone. Across the country, lawmakers and regulators are working to increase taxes, restrict access and delay implementation, while still collecting cannabis tax revenue.

This isn’t regulation. It’s exploitation.

If the federal government uses 280E to tax cannabis like contraband, and states overtax and underdeliver on access, then what exactly is being legalized?

Profits for the government. Headaches for businesses. Confusion for consumers.

Big Alcohol and Big Tobacco have already bet on cannabis

The same industries that fought cannabis legalization for decades are now some of its biggest investors:

- Constellation Brands (Corona, Modelo) invested $4 billion in Canopy Growth

- Altria (Philip Morris USA) invested $1.8 billion in Cronos Group

- British American Tobacco owns a major stake in Organigram

- Anheuser-Busch InBev partnered with Tilray to develop cannabis-infused beverages

The private sector sees the writing on the wall. So do the states. But Congress continues to ignore it.

The next generation of consumers has already chosen cannabis over alcohol and tobacco. Consider that Gen Z drinks 20 percent less than Millennials and prefers cannabis for socializing; tobacco use has plummeted, while cannabis use has increased; and cannabis is seen as a healthier, more conscious alternative to alcohol.

While younger generations normalize cannabis, the federal government still treats it like contraband.

Despite cannabis legalization spreading across the country, over 200,000 people were arrested for marijuana offenses in 2023. An astounding 92 percent of those arrests were for simple possession, with communities of color continuing to be disproportionately impacted. And people still lose jobs, housing and opportunity over a substance now legal in nearly half the country.

You cannot regulate, tax and profit off cannabis while continuing to criminalize it. That is not justice. That is hypocrisy.

The majority of the United States has embraced cannabis reform (See graphic 2):

The states have spoken. The voters have spoken. The markets have spoken.

Why hasn’t Congress?

It’s time for Congress and state legislators to stop posturing and start governing. A modern cannabis policy must include:

- Federal rescheduling of cannabis

- Potency-based regulation (not the outdated “hemp vs. marijuana” THC threshold)

- Repeal of Section 280E to allow standard business deductions

- Passage of the SAFE Banking Act to allow access to financial services

- Harmonization of federal and state law

- Expungement of nonviolent cannabis convictions

Congress has stalled long enough. Every day of inaction keeps businesses shut out of financial systems, people behind bars for outdated charges, and a thriving market stuck in legal limbo.

Cannabis legalization is no longer a question of if—it’s a test of whether lawmakers have the courage to catch up with reality.

The time for debate is over. The time for action is now. Let’s move cannabis from contradiction to clarity and from prohibition to progress.